Content: Page 41, Becoming Your Own Banker Fifth Edition

About 20 years ago, during the formative years of the development of the Infinite Banking Concept, interest rates were rather high, and I had been involved in the real estate business for several years. Because of that background and the painful experience of getting caught owing a lot of money at 23% interest, I developed some scenarios that demonstrated how one could phase out the high interest mortgages that were common at that time through the use of dividend-paying whole life insurance. It involved paying large life insurance premiums for four years and then borrowing annual mortgage payments from the policy at 8% to pay off the mortgage payments at 15%. Meanwhile, making premium payments to the policy that were the equivalent of what was being paid to the mortgage company.

People were fascinated with the idea but very few took any action because it required rather large premiums to make the transition, plus taking about 15 years to complete the process. It dawned on me later that, in the budgets of most folks, monthly payments on two automobiles plus comprehensive and collision insurance on them equaled their house payment! So, I built a scenario where one could finance cars through life insurance and sales picked up dramatically. This was something that was attainable in about four years and required less than half the premium to get the program going.

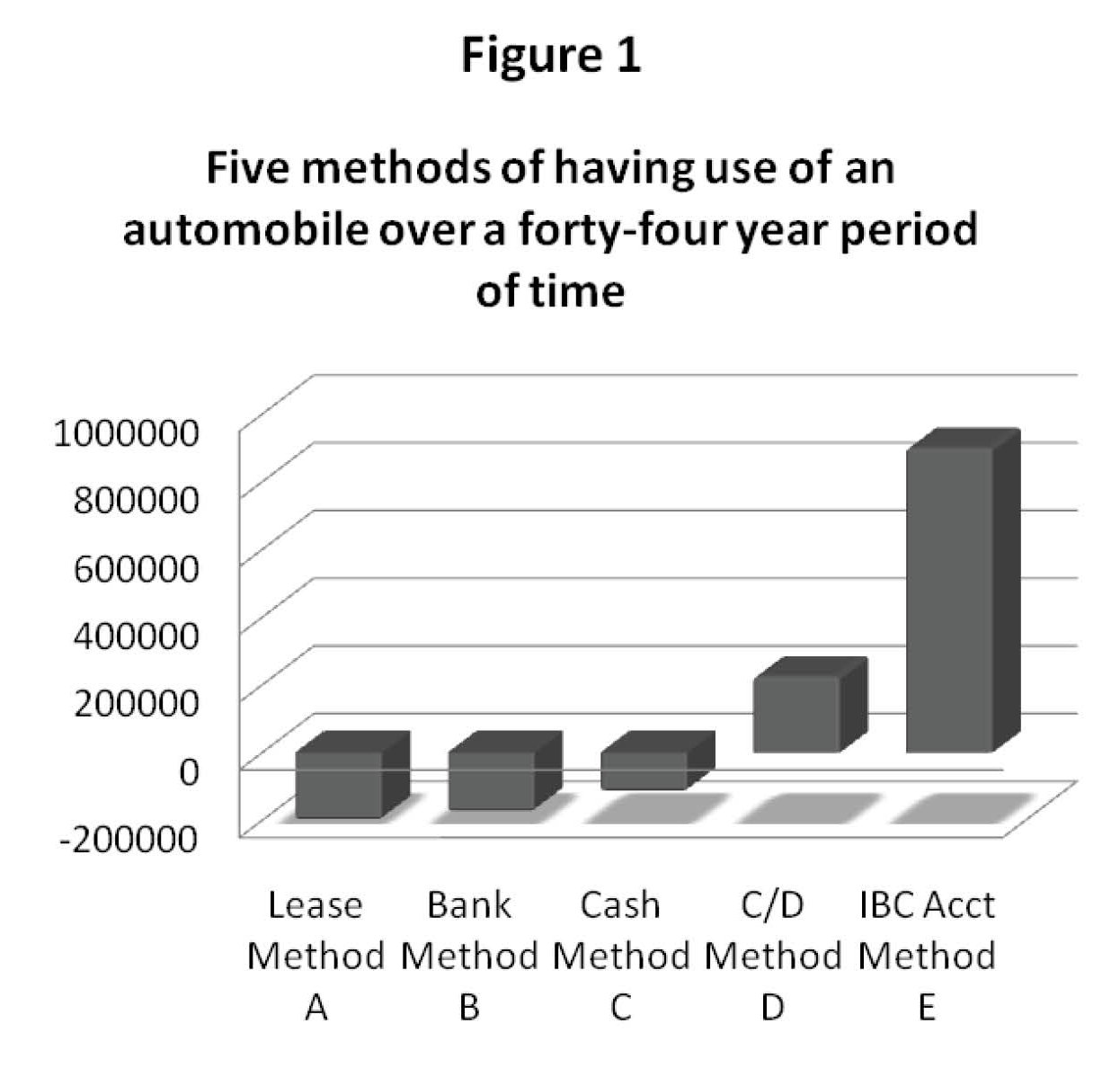

There are five legitimate methods of having the use of an automobile over the lifetime of a person. The graph on page 41 of BECOMING YOUR OWN BANKER assumes that the car will be replaced at four-year intervals and that the financing package will be $10,550 at 8.5% interest for 48 months ($260.00 per month) and we will be looking at a 44-year time frame in which to compare the results of the methods.

METHOD A – The first, and most expensive method, is to lease the cars each year for 44 years. It is somewhat difficult to calculate the total cost in this case. We must resort to reason and logic and use the second method as a starting point. At the end of each 4-year period the lessee has no equity to show for the expenditure and at the end of the 44 years he has nothing to drive – he is on his feet!

METHOD A – The first, and most expensive method, is to lease the cars each year for 44 years. It is somewhat difficult to calculate the total cost in this case. We must resort to reason and logic and use the second method as a starting point. At the end of each 4-year period the lessee has no equity to show for the expenditure and at the end of the 44 years he has nothing to drive – he is on his feet!

METHOD B – In the second method we are using a commercial bank or finance company to do the job. Calculating the cost here is easy – $260.00 per month for 528 months = $137,280.00. At the end of each 4-year period, this person has a 4-year old car to use as a trade-in on the next one. Reason tells you that the first method must be more costly than this one. If leasing were cheaper than buying, no one would ever buy – everyone would lease. That’s absurd because one has to lease from an owner. Why would an owner lease something for less than he paid for it? Therefore, let’s assign an arbitrary 44-year total cost of Method A at $175,000.00. By the way, the annual equivalent of $260.00 per month is $3,030.00.

METHOD C – The third method is to pay cash for each new car every four years. This person has a severe case of “The Arrival Syndrome” and thinks that there is no better method than paying cash for cars. This results in a total cost of $116,050 (10,550 for each trade-in package times 11 cars). He had to defer the use of the first new car for four years to achieve this result. He had to save up money for the first four years and immediately start accumulating money again in the same savings account to prepare for the next purchase. This is the classical “sinking fund” method of having the continuous use of machinery that will wear out periodically.

This method involves car payments just like the first two methods. It is all a matter of where the payments are made – to the leasing company, the commercial bank, or to his savings account. When the results of the three methods are drawn to scale on the graph, notice that there is not very much difference in them. As we move to the right on the graph the results are getting somewhat better – but the American buying habits are going the other way on the scale! Any number of radio and TV commercials report that leasing is up over 35% in the last 5 years.

For some real insight into what is really going on in the automobile world, go to the luxury car dealerships and ask the sales managers what percentage of their cars are leased. You will find that most of them are in this category.

We will save Methods D and E for the next lesson.