by L. Carlos Lara

One of the greatest awakenings we can experience happens when we recognize that our monetary systems rest entirely on our confidence. In other words, when analyzed from a purely materialistic viewpoint, our beliefs in the financial strength of the U.S. dollar and the U.S. Treasury are what actually keeps our economy propped up. Our trust in these monetary instruments sustains us.

But since confidence is psychological in nature it is immensely fragile and can, under certain conditions, evaporate in the minds of people in an instant. We have plenty of historical evidence to back up this claim and we don’t need to go back any further than the 2008 financial crisis to prove this to ourselves. The idea that “this time it will be different” has been proven wrong time and again.

Of equal importance is understanding that confidence in a nation’s money is built up in a society over time and eventually becomes a self-reinforcing mechanism. But once that confidence is lost it’s nearly impossible to win it back. The country of Venezuela is the most recent example of a currency crash that was caused by the people’s loss of trust in their government’s money. Long before the recent Venezuelan events in current headlines, its citizens had already abandoned the bolivar and considered it to be so worthless that they got rid of it as fast as they could by trading it in the black market for U.S. dollars.

Alternatively, the confidence the Japanese people display toward their country’s currency is the exact opposite. The Japanese people trust the yen so much they literally hoard it. In fact, the Japanese savings rate is an incredible 51% as of June 2018! Compare this to our meager 3.1% savings rate here in the U.S. and we can’t help but to be surprised. It seems inexplicable that its society should behave in this way especially after two decades of continuous Quantitative Easing (QE) by their central bank, which has by now monetized half of the country’s debt, and has done it all with negligible signs of price inflation! What’s going on? The Japanese seem to be of a mindset that keeps them from spending their money. Consequently, this self-enforcing mechanism may have contributed to keeping consumer price increases in check.

It’s as though the people of Japan have adjusted to their economic reality of low, and even negative interest rates, since anyone under 40 has never really known anything any different. To be clear, Japan’s problems are much more numerous and certainly more complex than what I am stating here, but the psychological conditioning aspect that seems to be harnessing prices cannot be ignored. And, because it is mental in scope, we should also recognize that this mindset could easily vanish in a flash, especially if the yen’s purchasing power should suddenly decline.

This brings us back to our own domestic affairs. No matter what our particular investment strategy may be, or what methods we plan on using to weather the coming financial storms, the recognition of the frailty of this trust factor in our monetary systems must be front and center in our thinking at all times as we analyze the market forces that play out daily in our own economy. If our currency should ever fail it will be because confidence in it has evaporated. Consequently, our overall financial strategy should include a remedy for that particular event should it occur.

Since this is certainly an important factor in the management of our economic responsibilities I am often asked if there is one main barometer for measuring the changing attitudes of people regarding this confidence issue and the currency, especially now under our present economic environment.

Understanding the Consumer Price Index (CPI)

Gauging the direction of the national and global economy is the work of economists and the number of indicators they use to predict these directions is as varied as the different economic schools of thought to which they belong. But certainly one indicator that has been used by all of them since it was first established in 1913 is the Consumer Price Index (CPI).1

The CPI is a way to measure the “cost of living,” or what is often referred to as the “purchasing power of our currency.” The CPI examines the weighted average of certain prices of a basket of consumer goods and services, like food, beverages, apparel, housing, medical care, recreation, and transportation, just to name a few.

But you must also be aware that the CPI also excludes certain other prices such as investments (stocks, bonds, mutual funds, etc.), life insurance and real estate. Due to this discrimination in prices the CPI can at times be puzzling, even to the sophisticated bankers of the Federal Reserve because predicting its direction is not an exact science. This may be because individuals are subjective in their decision-making, especially when it comes to how they spend their money. These decisions are emotional decisions.

What we can understand from the CPI is that when CPI prices rise, it means that our cost of living has gone up because the purchasing power of our money has declined. Obviously, this can create a very negative attitude among all of us and has a very direct effect in our confidence factor toward our money and, by extension, our government. Hence, “price inflation” is dreaded by everyone so a close watch is constantly kept on its up or down movements, especially by the Federal Reserve.

Recalling one event from history can emphasize this case in point. After President Nixon closed the gold convertibility window internationally ending the Bretton Woods Agreement of 1945, inflation in the United States and abroad soared. It reached 14.8%2 here in the U.S. in March of 1980 and threatened to spiral out of control.

Federal Reserve Chairman Paul Volker acted quickly and decisively by increasing interest rates in order to stop price inflation’s dangerous spread. His actions were tough and literally shocked the nation into submission, including myself in my own personal business affairs. His actions sent the commercial bank’s prime rate spiraling upwards to 21½% at one point! Millions of Americans were devastated, but eventually, over time, the CPI settled into the 2% to 3% range as an annual increase that we now have, and confidence in the nation’s monetary system was eventually restored.

However, Consumer Price Inflation as reflected by the CPI is vastly different from the price inflation attributed to the other asset classes not included in the basket of prices of the Consumer Price Index. Here I refer to stocks, bonds, mutual funds, real estate, in fact, the entire spectrum of investments, which are left completely out of the CPI.

Point being that the Federal Reserve’s near-zero interest rates and QE program directly inflated these specific asset classes over the past decade. This is where the real economic harm has been committed and where the real danger currently lies. When these inflated asset prices reverse course, which is only a matter of time before they do, it will create immense havoc for commercial banks as a starting point and potentially spread to the entire financial system as a whole. This is why Bob and I have stated repeatedly that all that Ben Bernanke’s QE Program actually accomplished was to set us up for a much bigger financial meltdown than what we all experienced in 2008.

The Wealth Effect

In Chairman’s Ben Bernanke’s Op-ed column for The Washington Post dated November 5, 20103 he made it perfectly clear that his near-zero interest rate policy and QE program would directly drive up prices in the the stock market, and that it would be done deliberately in order to create a wealth effect that would “help increase confidence”4 in our economy. Keep in mind that we were struggling to emerge from a serious recession during the time of this program. More specifically, the ongoing purchases of over $2 trillion in U.S. Treasuries and Mortgaged Backed Securities by the Fed, beginning in 2008 and ending in 2014, was intended to make stock prices rise and Bernanke noticed with approval that “long term interest rates fell when investors began to anticipate this additional action,”5 on the part of the Fed each quarter.

I have repeatedly watched Bob Murphy show audiences exactly how Ben Bernanke inflated the stock market, as well as how other Fed Chairmen before him did the very same thing. But not only was the stock market artificially inflated, so was the real estate market! As Ben Bernanke made clear, “… Lower mortgage rates will make housing more affordable and allow more homeowners to refinance.”6 When interest rates are kept incredibly low, real estate speculators cannot resist the availability of cheap money and will take actions that will naturally drive up real estate prices on a national scale.

But the one stimulus that Ben Bernanke says the QE program will directly impact are bond rates. “Lower corporate bond rates will encourage investments.”7 Indeed! When yields are at nearly zero for a prolonged period of time, fixed income (bond) investors are forced to chase after yields anywhere they can find them, which motivates corporations to arbitrage the cheap Fed money against the going market rate by issuing their own corporate bonds. This type of cocktail mixture can become lethal as it stimulates the “junk bond” market, which it has done. Unfortunately, for some companies it has grown into a potential $1 trillion dollar time bomb!

The Fed’s Cheap Money Can Be Deadly

During the economic recession associated with the 2008 financial crisis, many corporations experienced weak sales growth and anemic returns. Additionally, due to the crisis, many companies stopped paying dividends to their stockholders. In order to prevent a sell off of their company shares many companies used the Fed’s low interest rates to issue their own corporate bonds and used the cash to buy back their own corporate shares.

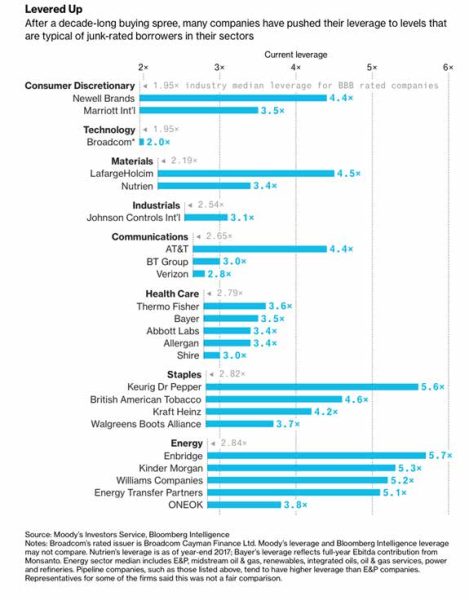

By reducing the number of outstanding shares, a company’s earnings per share (EPS) ratio are automatically increased. This created a quick fix to their financial statements and made them look more attractive to stock investors. Other corporations, however, used the cash to buy out competitors. But many of these corporate acquisitions may have over leveraged these companies by carrying two, three, and even up to five times more debt than their company earnings (before interest, taxes, depreciation and amortization—Ebitda). Yet many of their bonds were still given a BBB investment grade rating by the rating agencies.

Bloomberg intelligence identified “50 of the biggest corporate acquisitions over the last five years and found that they contributed to a surge in debt rated bottom investment-grade tier (BBB) bonds that pushed their leverage to levels typical of junk-rated peers.”8 These bonds now represent almost 50% of the $2.47 trillion of U.S. corporate debt rated in the BBB market. As Bloomberg analysts see it, “Any hiccup in the economy or exodus of investor cash will lead to a surge of downgrades to junk rating. And if it were to happen en masse, it could overwhelm the $1.3 trillion U.S. speculative-grade debt market and potentially cause the weakest borrowers to lose access to capital.”9 When deprived of cash and credit a company cannot survive.

Assets Are Collateral For Lenders

Keep in mind that assets support loans. Consequently, when assets are inflated in the way they are now, not only does everyone feel “wealthier,” but it also promotes bigger loans.

But what happens when these assets deflate? Suddenly the borrower’s collateral will no longer cover the loan. This forces banks and other lenders to act to seize and protect their collateral.

Since commercial banks tend to over collateralize themselves thereby becoming the secured creditor in bankruptcy proceedings, banks will deliberately push many companies into these courtrooms in order to get paid. But if the rout in asset deflation occurs en masse then banks will have a much bigger problem to face, which is investor panic and bank runs. If the rout is severe enough it can have a devastating effect on the entire U.S. financial system due to the systemic risk problems inherent in banks.

This is why a program of low interest rates and QE cannot be maintained forever and the Federal Reserve knows this all to well. While they can temporarily inflate asset prices to psychologically give us that artificial wealth boost they also know it can go too far and, in fact, it already has. This is why they are persistently raising interest rates despite President Trumps’ displeasure.

In response to these interest hikes the stock markets are reacting wildly and real estate sales are slowing down. The trick, of course, is to bring these asset prices down gradually and somehow avoid the dreaded panic that sets off the bank runs. The problem is that when matters get to where they are now, it’s every man (investor) for himself and that’s when our individual actions, when done en masse, create the avalanche.

Are we there yet? As always this is difficult to pinpoint precisely. For example, and just to illustrate the varying sentiments that are tied to stock market investing: Recently, there were flash reports circulating from several news sources that individual stock investors (that is, “Mom and Pop” investors) had for the past several weeks been the ones buying the “dips” after each major stock market plunge while institutional and hedge funds were the net sellers! (This is data gathered from Bank of Americas’ Merrill Lynch Brokerage Services.).11

I don’t know about you, but this news strikes me as so unbelievable that I don’t even know how to properly comment on it except to call it pure gullibility—a sort of “pin the tail on the donkey,” scenario. Unfortunately, this is nothing new. I have actually witnessed this sort of behavior before, just prior to the 2008 crisis, but one would think that people would eventually learn not to do this sort of thing.

Add to this example another case in point of diverse investor attitudes. This one comes from an emergency phone call that was received by my attorney just three days ago. He is allowing me to share it with you because it was a message that was very hard for him to believe since it came from his stockbroker— and stockbrokers normally don’t say this sort of thing. Basically, he told my attorney and I quote— “sell every stock position you own— immediately!”

One thing is certain, we cannot ignore that the stock market as well as the real estate market are very emotional markets and we never know when human sentiment toward them will change all at the same time. Nevertheless, as the stock market continues to lose ground most sophisticated investors are beginning to realize that they could now lose serious money in the stock markets, so thoughts of capital preservation are definitely reaching a new high. Risk-reward strategies are shifting. There is movement toward the safety and quality found in short term U.S. Treasuries where yields are now rising above the CPI’s inflation barometer.

Even so, it’s still all a dicey maneuver moving capital away from risk to safety before it all comes crashing down all around you. It’s like a game of musical chairs and you definitely don’t want to be the last man standing.

Conclusion

Trying to time the stock market is impossible, but as the markets rise and fall more precipitously each time it’s difficult not to begin anticipating when its time to cash out. As long as we have an equal amount of buyers and sellers the sloshing back and forth can continue for some time, but once the direction is all selling, each of us will know if we acted in time, or not.

Bob’s and my strategy for these turbulent times has not changed and has actually become more relevant than ever as the time of reckoning draws nigh. It’s a simple yet well-balanced formula divided into three easy to understand steps. These steps can be found in many of our LMR articles or you can simply watch the video How To Weather The Coming Financial Storms, to gain an understanding of its fundamentals.

It all boils down to this. At its very essence our economic philosophy rests in our belief in learning to become our own bankers. To learn the origins and theory of this amazing concept read the book that started it all, Becoming Your Own Banker by R. Nelson Nash: https://infinitebanking.org/product/becoming-your-own-banker/

Also, read our newest book that covers all these privatized banking principles in a fresh new light The Case For IBC—How To Secede From Our Current Monetary Regime One Household At A Time, by R. Nelson Nash, L. Carlos Lara and Robert P. Murphy, PhD, by R. Nelson Nash, L. Carlos Lara and Robert P. Murphy, PhD.

It’s not too late to get started and the positive results are incredibly quick. There is a way out of this flawed monetary system and the sooner you incorporate it into your own financial affairs, the sooner you can relax.

References

1. Bureau of Labor Statistics, Consumer Price Index, https://www.bls.gov/cpi/questions-and-answers.htm, October 29, 2018

2. Paul Volker, from Wikipedia, the Free Encyclopedia, https://en.wikipedia.org/wiki/Paul_Volcker, October 29, 2018

3., 4., 5., 6., 7. Board of Governors of the Federal Reserve System, Chairman Ben S. Bernanke, Op-ed column for the Washington Post, November 5, 2010, Researched October 29, 2018, https://www.federalreserve.gov/newsevents/other/o_bernanke20101105a.htm

8. 9., 10., Bloomberg, “A $1 Trillion Powder Keg Threatens the Corporate Bond Market, Article by Molly Smith and Christopher Cannon, October 11, 2018, https://www.bloomberg.com/graphics/2018-almost-junk-credit-ratings/?srnd=fixed-income

11. Bloomberg, “Mom and Pop Are Buying the DIP in Stocks While Pros Stay Put,” article by Lu Wang and Vildana Hajric, October 23, 2018, https:// www.bloomberg.com/news/articles/2018-10-23/mom-and-pop-are-buying-the-dip-in-stocks-while-the-pros-stay-put?cmpid=BBD102418_MKT&utm_ medium=email&utm_source=newsletter&utm_term=181024&utm_campaign=markets