by L. Carlos Lara

Highly profitable companies can run into financial trouble if they don’t have the liquidity to react to unforeseen events. Even companies with a stockpile of assets on their balance sheets will struggle with cash flow issues when markets crash if those assets are illiquid. In a moment of crisis, assets are of no value if they cannot easily be converted to cash in order to save the company.

This one contingency—the liquidity factor—is the main reason corporate analysts often make use of liquidity ratios when analyzing a company’s financial strength. What they are examining is the ease with which a company can meet its financial obligations with the liquid assets available to them. A company can seem very solvent in normal times, and have a big cushion of shareholder equity, but if a crisis hits and the assets are very long-term and illiquid while the liabilities were short term then the company could become insolvent quickly.

Since I am familiar with these ratios and often use them to study company balance sheets, I have been most impressed with the liquidity measurements I have seen in the life insurance industry. Their ratios are significantly stronger and more conservative than any other major money intermediary in our entire economy.

The structure of their balance sheets is perhaps the main reason why historically the life insurance industry has shown incredible resilience in the midst of the two worst financial catastrophes in modern history—the Great Depression of the 1930s and the 2008 financial crisis. So impressed are we with this fact that Robert and I have written extensively on this subject numerous times in the LMR. (For example, see the April 2012, August 2012, January 2013, April 2013, May 2014, and October 2014 issues of the LMR for articles dealing with the relative strength of the insurance sector.)

DOES THE LOW-INTEREST RATE ENVIRONMENT MAKE A DIFFERENCE?

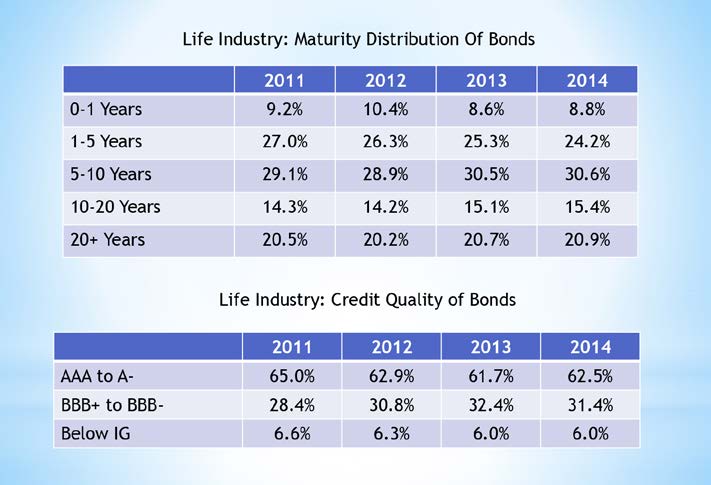

Regardless of the impressive historical record, there has been a growing concern within the last few years about the current financial stability of the life insurance industry in light of our unprecedented low interest rate environment. Quite frankly, I can understand why, and the concern expressed is logical. After all, life insurance companies do have the bulk of their assets invested in bonds (70% as of 2014), and the products life insurers offer are particularly dependent on the interest rate yields of these bonds. Consequently, not only is this a good question that deserves a good answer, but the LMR should be the first to address it since we advocate the stability of the insurance sector so fervently.

Let me begin to answer this worry by stating at least this much right now. Although it’s true that this extended low interest rate environment has indeed put extra stress on the earnings of life insurance companies these last seven years, our research continues to reveal that it has not materially impacted their solvency. In fact their financial strength is as resilient as ever. In the remaining parts of this article I will explain why and also how life insurance companies are able to continue to retain their staying power.

SUMMARY OF THE MONETARY INTERVENTION BY THE FEDERAL RESERVE

The Federal Reserve is the chief instigator of our low interest rate environment. Since 2008 it has been on a campaign aimed at stimulating economic growth by deliberately pushing down the market rate of interest to historic lows. One of its most aggressive activities has been to purchase a massive amount of assets, which has effectively pushed down the fed fund rate to zero. These open market operations, known as “quantitative easing (QE),” have ballooned the size of the Fed’s balance sheet to over $4.5 trillion. According to the Center for Insurance Policy and Research (CIPR) in a newsletter dated 2014: “the 10-year Treasury plunged from a yield of 4.68% at the start of 2007 down to 1.38% in July of 2012.”1

Even though it was back up to 3.04% at the end of 2013, the 10-year Treasury has come back down again to 1.84%2 this month, while the economy has remained anemic. The Fed’s commitment under Chairman Yellen is to continue to keep interest rates low until stronger signs of economic recovery become more evident. Unfortunately, this prolonged strategy will continue to have an unpleasant impact on Life insurers and there is no way around this particular part of the problem at this time.

TOP RATING AGENCIES GIVE LIFE INSURANCE COMPANIES A THUMBS UP

Nevertheless, most market analysts still hold a very positive outlook for life insurance companies regardless of the low interest rate environment. In a recent (2015) end of the year announcement Moody’s predicted a stable 2016 outlook for life insurers.3 Fitch had an almost identical outlook for life insurers claiming that “Fitch’s stable outlook considers the industry’s very strong balance sheet fundamentals, strong liability profile, and stable operating performance,” and it continues to view “… the industry’s liquidity profile as strong.”4 Not to be outdone Standard & Poor’s (S&P) also gave life insurance companies a thumbs up in their report for 2016 by saying that, “US life insurers can weather the storm!”5 Obviously, the top three rating agencies are very positive about the life insurance sector. Perhaps we should also mention here that approximately 50% of the life insurance industry’s bond portfolio is made up of investment grade corporate bonds, which have a current yield of 3.6%. In other words, it’s not all Treasuries. Lower yielding assets that mature can and are often rolled over into new conservative higher yielding investments of this type, which can improve the investment portfolio of life insurance carriers without going into riskier investments. Furthermore, the quality of these bond investments adds to their liquidity. Short of a currency crisis, they can be converted to cash quickly.

Still, this all seems paradoxical that credible sources such as Moody’s, Fitch, and Standard & Poor’s can be so optimistic about the life insurance industry in light of such prolonged interest rate lows. But before I explain why there is so much optimism among these analysts, let’s first be certain we understand exactly where the damaging effects of the low interest rates are impacting the life insurance companies.

THE TOWERS WATSON LIFE INSURANCE CFO SURVEY

In a recent survey conducted by Towers Watson, a global professional services firm specializing in risk management, life insurance CFOs were interviewed about their primary business concern. All participants (97%) stated that the prolonged low interest rate environment was their number one chief concern.6 Here’s why:

“Life insurer’s earnings are typically derived from the spread between their investment returns and what they credit as interest on insurance policies and products. If their contractually guaranteed obligations exceed achievable returns in the capital markets for a certain length of time, life insurers’ ability to meet expectations can be greatly reduced.” —The Center for Insurance Policy and Research (CIPR)7

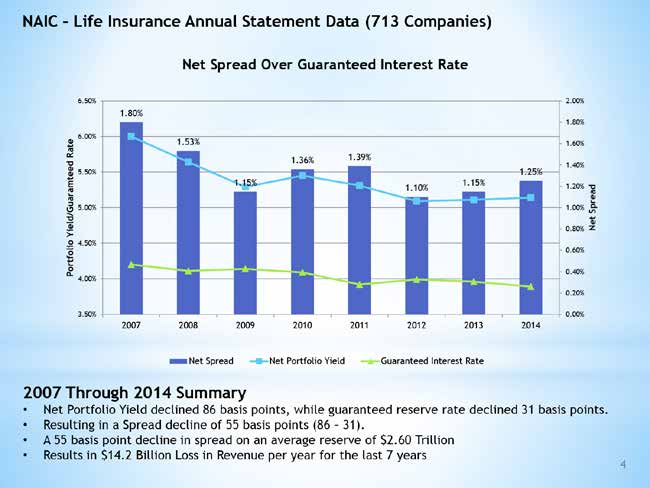

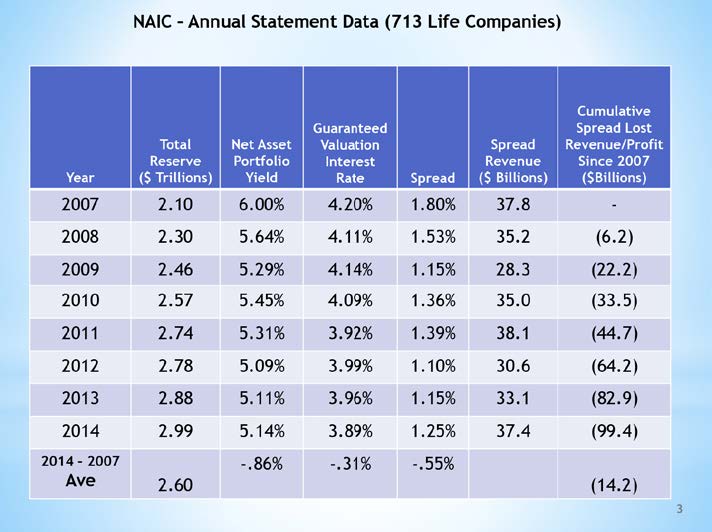

Adding to this, a recent National Association of Insurance Commissioners (NAIC) Study of the annual financial statements of 713 life insurance companies from the periods 2007-2014 clearly indicated a squeeze in the spread between the net investment portfolio yield and the guaranteed interest rate to policy holders. Investment net spreads actually declined 55 basis points during this seven-year period or what amounted to approximately $14.2 billion in lost spread revenue per year. (SEE: Slide 4 from the NAIC Study)8

So what we see is that the pressure being felt from the low interest rate environment for life carriers is in their spread revenue. Keep in mind that actuaries discount all future events at some implicit rate, and therefore present assets—even “safe” ones—must generate a return in order to meet future obligations. Consequently, any damaging effects to earnings would most certainly concern a life insurance CFO.

EARNINGS COMPRESSION VS. RESERVES

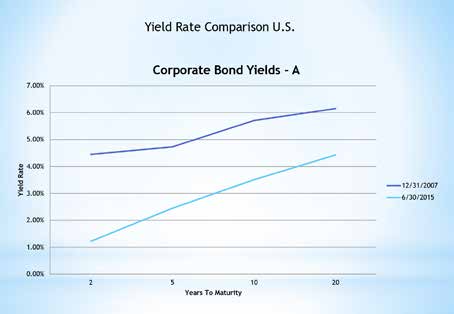

It’s interesting to note that most life insurance portfolios have come out of the higher yielding bonds of the past and now have rolled into the current yields of 5% on average according to the NAIC study. (SEE: Slide 6 & 7 from NAIC Study) What is still being credited back to many policyholders is nearing almost the same interest rate earned in the capital markets. This is where the earnings compression is coming from.

Fortunately, minimum valuation interest rates going forward on new policies are determined each calendar year and locked in at policy issue. After that they do not change. These minimum interest valuations over the last six years have been gradually adjusting downward in order to relieve some of this earnings compression.

But the interest credited back to policies is still generally greater than any other interest rate offered by a similar type of safe investment in the market place, such as a bank certificate of deposit (CD), or similar vehicle. This is one reason why under this low interest rate environment new business continues to pour into the insurance sector and why those savers who are already inside the insurance sector stay inside.

Now comes one of the most important and unique attributes of life insurance companies. The principal liabilities on life insurers’ balance sheets are actually policy reserves— assets that are held in custody for policyholders to cover all present and future claims. The establishment of reserves is by law purposefully conservative in the sense that they usually result in an overstatement of future expected claim costs. This necessarily creates excess funds, which are invested for a profit and create additional reserve cushioning.

We see this more specifically in the pricing of life insurance products where there is not only an investment-spread margin, but also a spread margin on an expense component and a mortality component. All of which are calculated greater than actually experienced by insurers and serve to create the extra surplus.

The $14.2 billion dollar spread loss per year (2007-2014), occurred against average reserves of $2.60 trillion. “While this is significant, the life insurance industry is still in a position of positive net investment income spread. Consequently, the period of the low interest rate environment created spread compression on earnings, but it did not materially impact the life insurers’ solvency.” CIPR Newsletter, July 2014 (SEE: Slide 3 from NAIC Study)9

THE KEY TO MITIGATE RISK IN A LOW INTEREST RATE ENVIRONMENT

The life insurance industry’s ability to manage the ongoing structure of their assets and liabilities is accomplished by the employment of future planning “cash-flow analysis.” It is these asset liability management (ALM) programs10 that not only help insurers mitigate low interest rate risk, but also prepares them for the rise in interest rates when they come.

In the current low interest rate environment earnings compression necessarily pushes statutory reserves on all new policy issues. Therefore, future cash flow planning is not only essential, but it is a required statutory valuation law. Companies must perform an annual cash flow testing exercise by building a financial model of all of their inforce assets and liabilities and then matching them together.

What happens next is nothing short of astounding. The company must then run the financial model out several years, generally five to ten years, until any remaining in-force liability at the end of the projection is insignificant. This is done using different interest rate scenarios and at least seven of those interest rate scenarios are provided by state insurance regulators known as “the New York 7.” This amounts to 1,000+ scenario calculations. If the chief actuary determines a significant amount of mismatch exists between the assets and liabilities of the company, an additional reserve amount must be posted to cover any interest rate risk embedded in their balance sheets.

These ongoing stress tests and especially the establishment of additional reserves are key components that serve to continue to fortify the financial strength of life insurers. A conclusion that is consistent with the recent optimistic outlook given to the life insurance industry by the three largest rating agencies of financial institutions.

CONCLUSION

Despite the unusual and prolonged low interest rate environment, which many experts now agree has been grievously ineffective and damaging to the economy, it is reassuring to know that the overall financial strength found in the life insurance sector coupled with their sound management techniques continue to make them resilient against major economic shocks. They have met this challenge two other times before and the confidence in them remains positive. In essence “they can weather the storm,” as the S&P rating agency announced.

What we must understand when we study statistical information such as this is that underneath it all we live in an economic world where our government officials are dead set against savings and are very supportive of the investment markets. Yet most prudent analysts now see these investment markets due for a major correction. There is worry that investors will flee from these investment markets in mass. This is why we believe government laws, such as Dodd-Frank and the more recent DOL ruling, are attempting to keep investors “in the market.”

As a matter of interest, the CFO Survey revealed one other intriguing fact. In addition to the low interest rate environment being a major concern, the interviews also revealed that “(87%) of them believed that there was a 50% or greater likelihood of a major disruption to the economy in the next 18 months. 27% believed that there was a 75% likelihood of a major disruption and 7% saying it was almost certain.”10

Whether these sentiments have lessened or increased since this survey was taken is difficult to tell. But chances are they have not abated, and the concern has probably increased. It remains to be seen when exactly the financial market crash will actually hit. But if the crisis to come is as severe as many predict it will be, the life insurance industry has a much greater chance of surviving it than other major financial institutions.

References

- CIPR Newsletter, January 2014 – http://www.naic.org/cipr_newsletter_archive/vol10_rising_interest_rates.pdf

- Bond-Yields The New York Times May 21, 2016 – http://markets.on.nytimes.com/research/markets/bonds/bonds.asp

- Moody’s Investor Services – https://www.moodys.com/research/Moodys-Stable-global-life-and-PC-insurance-outlook-for-2016–PR_340808

- Fitch: Stable Outlook for U.S. Life Insurers in 2016, Reuters, December 2015 – http://www.reuters.com/article/idUSFit94290420151210

- S&P Outlook stable for US life insurers, The Life Insurance Investment Journal article January 21, 2016 – http://insurance-journal.ca/article/outlook-stable-for-us-life-insurers/

- Towers Watson Life Insurance CFO Survey, June 2012 – https://www.towerswatson.com/en-US/Insights/IC-Types/Survey-Research-Results/2012/06/Life-Insurance-CFO-Survey-30

- CIPR Newsletter, January 2014 – http://www.naic.org/cipr_newsletter_archive/vol10_rising_interest_rates.pdf

- NICA Life Insurance Annual Statement Data & Study (713 Companies) 2015 – http://www.naic.org/meetings1508/committees_ex_financial_stability_tf_2015_summer_nm_materials.pdf

- NICA Life Insurance Annual Statement Data & Study (713 Companies) 2015 – http://www.naic.org/meetings1508/committees_ex_financial_stability_tf_2015_summer_nm_materials.pdf http://www.naic.org/cipr_newsletter_archive/vol10_rising_interest_rates.pdf

- Towers Watson Life Insurance CFO Survey, June 2012 – https://www.towerswatson.com/en-US/Insights/IC-Types/Survey-Research-Results/2012/06/Life-Insurance-CFO-Survey-30