by Robert P. Murphy

A common method of showing the public the power of Nelson Nash’s Infinite Banking Concept” (IBC) is to stress its feature of “constant compounding.” In contrast to many other asset classes, dividend-paying Whole Life insurance always increases in value. Indeed, some proponents of IBC enthusiastically declare: “There’s nothing else like it!”

In this article I will explain what Nash’s fans have in mind. As we will see, there really is something special about IBC; it allows households and business owners to enjoy “constant compounding” in a very safe and convenient way, which cannot be matched by other (standard) assets. However, as with most claims, there are some caveats involved (particularly the interest accruing on outstanding policy loans), and I want to make sure the readers of the LMR understand all of the nuances on this powerful topic.

IBC AND POLICY LOANS: THE BASICS

In order to focus on the specific issue of constant compounding, I am going to assume in this article that the reader has a basic familiarity with IBC as a cashflow process, and how it uses a dividend-paying WholeLife insurance policy as the platform for implementing it. For those readers who need this foundation in a quick way, I refer you tothe podcast series that Carlos and I produce, in particular episodes 17, 18, and 19.1 For those willing to put in more time, there is no substitute for reading Nelson Nash’s classic book, Becoming Your Own Banker.

For our purposes in this article, let me review the essential mechanism: A dividend paying Whole Life insurance policy comes with built-in, contractual guarantees on the growth of the “cash surrender value.” This is the amount that the life insurance company will give the policyholder if he or she decides to collapse (“surrender”) the policy and stop making premium payments. Of course, this dollar amount is lower than what the death benefit would have been, if the insured party had died, but with large policies the cash surrender value can grow quite large. Intuitively, it is how much the life insurance company is willing to pay the policyholder to “walk away” from the contract, letting the insurance company off the hook from having to pay the looming death benefit (which gets closer every passing day, since the insured person will eventually die or reach the age—such as 121 years old—at which the contract matures).

Now rather than surrender the policy outright, a policyholder who needs money has another contractually guaranteed option: He or she can take out a policy loan, up to (almost) the cash surrender value. It’s important to understand exactly what is happening here: The policy loan is a loan made on the side, from the life insurance company to the policyholder. It does not directly involve the life insurance policy itself; the customer isn’t “taking money out of the policy.” Rather, the life insurance company is simply directing some of its outgoing cashflows—which it otherwise might use to buy corporate bonds or other assets—into loans to its own customers.

These policy loans are actually the safest investment possible from the life insurance company’s point of view, because the company itself is guaranteeing the underlying collateral on the policy loans: namely, the cash surrender value of the policies in question. Even if the borrower (i.e. the customer who is requesting the policy loan) never pays a penny on the outstanding policy loan, the life insurance company has no worries. The outstanding policy loan rolls over at compound interest (according to the interest rate on the policy loan, which is itself determined by a contractually-fixed formula), and it eventually gets “paid back” either when the insured dies or reaches the maturity age and the contract ends.

A CAR EXAMPLE

For example, suppose a fan of Nelson Nash has begun implementing IBC in his personal life, and is making large premium payments into a properly designed Whole Life policy. When it’s time for this man to buy a new car, he doesn’t need to rely on financing from the dealership or an outside lender. Instead, the man takes out a policy loan for (say) $25,000, and pays the full purchase price to the car dealer to buy the car outright on the spot.

Now even though the man wrote one big check himself from the perspective of the car dealership, in reality the man obtained the financing for his purchase by borrowing against the cash surrender value in his well-funded IBC policy. In order to play “honest banker” with himself, the man starts making (at least) the same monthly “car payments” to the life insurance company, as if he had borrowed from a traditional lender and had to make car payments at a standard interest rate.

However, even though the man intends on mirroring the same cashflows doing it the IBC way, in reality he is much more secure and can sleep soundly at night. If he suddenly loses his job, he has the option of not making his “monthly car payments” to the life insurance company. His outstanding policy loan of $25,000 won’t get knocked out, and instead it will keep growing at interest.

Yet to repeat, the life insurance company has no problem with this scenario. It won’t send repo agents to seize the car. Remember, legally speaking the man bought the car outright from the dealership. The car is not the collateral on the policy loan; his life insurance policy’s cash value is.

Suppose the man never makes a payment, and the policy loan grows to (say) $40,000, many years later. Further suppose the man dies of a heart attack, and at this point the death benefit on his policy is $500,000. In this case, his named beneficiary (let’s say it’s his widow) only gets a check for $460,000. This is because the life insurance company first “pays itself back” for the full value of the outstanding policy loan, before sending what it owes to the beneficiary.

I hope this simple example illustrates the advantages of financing major purchases with IBC (rather than traditional lenders), but also clarifies why the life insurance companies agree to this arrangement which at first seems too good to be true to some members of the public.

PAYING CASH VERSUS CONSTANT COMPOUNDING

The fans of IBC will often bring up the special feature of “constant compounding” when contrasting the virtues of their approach with the strategy of “paying cash” for big purchases. In this section, I’ll explain what the fans of IBC have in mind with this discussion.

Imagine a woman who follows a very conservative approach to money. She has been taught to avoid debt, and to only buy things “that she can afford.” Consequently, if this woman wants to buy a $25,000 new car every few years, she sets up a sinking fund using certificates of deposit (CDs) issued from her local bank. (Alternatively we could imagine her putting money into a bank savings account, a money market mutual fund, etc.)

What happens is that the woman first figures out what (after-tax) interest rate she is likely to earn on her very conservative investment in bank CDs. Then, using an amortization calculator, she figures out how much money she needs to put into the sinking fund every month, so that when it’s time to buy a new car, her growing stash of CDs has a total market value of $25,000 (less whatever trade-in value she’ll get for her used car at that point).

This is a very conservative approach, pushed by the likes of “get out of debt” gurus such as Dave Ramsey. Compared to the typical American who “lives beyond his means” by running up credit card and other types of debt in order to fuel consumption, our hypothetical woman is behaving very responsibly.

However, the fan of IBC might point out to the woman that her strategy involves draining out her wealth fund every time she buys a new car. In other words, the value of her “car fund” grows over time, but whenever it hits $25,000, she redeems her bank CDs and hands over the $25,000 to the car dealer. At that point, the woman has no financial assets due to this enterprise, and she must start over from $0. In particular, the woman certainly can’t earn interest income on her previous contributions into the “car fund,” because that money is now gone forever—it was handed over to the car dealer.

In contrast, suppose the woman avoided bank CDs as her financial vehicle, and instead built up a well-funded dividend-paying Whole Life insurance policy. So long as she kept making the premium payments, this policy would continue to grow over time, with an ever-higher cash surrender value and death benefit (if designed according to IBC principles). When it was time for her to buy a new car, the woman would not “take money out of the policy”—the way she might cash in CDs or write a check drawn on a bank savings account—but instead she would take out a policy loan against the cash surrender value in her policy. The life insurance policy would not “fall in value” because of this move; it would keep chugging along on its own,2 with the outstanding policy loan merely representing a lien against this asset.

AN ANALOGY WITH HOME EQUITY LOANS

In order to comprehend what’s happening, it might help to use an analogy with home equity loans. Suppose our hypothetical woman never heard about cash-value life insurance, and she had been building up her bank CDs in the fashion that her very conservative parents had taught her.

At the same time, she also owns a paid off house. (Remember, she avoids debt as a rule.) In Year 1, the house had a market value of $100,000. In Year 2 it rose to $105,000. In Year 3 it was $110,250, and so on. Every year, the house tended to rise about 5 percent in market value.

Now it was time for the woman to buy her new car, for $25,000. She originally planned on cashing in all of her bank CDs, depleting her sinking fund down to $0. But her friend points out that she could alternatively take out a home equity loan against the value of her house. In this case, she could still buy the car outright—there would be no lien against the automobile—with the equity in her house serving as the collateral. With this approach, the woman could retain her stash of bank CDs, which would continue to appreciate at the interest rate the bank offered.

Furthermore, the house itself would also continue to appreciate in market value, so long as real estate kept rising. In other words, the market value of the woman’s house would not be “dragged down” because she decided to borrow against it, in order to finance the new car purchase. It is crystal clear that the market value of her home is a completely separate concept from the outstanding value of the home equity loan she takes out from the commercial bank.

In this context, the woman’s friend might point out to her, “If you cash out your bank CDs, you will stop earning interest on them. But if you finance your new car purchase by borrowing against the equity in your house, then you continue to earn the CD interest and you still reap any appreciation in real estate on your house.”

I hope that this analogy with a home equity loan sheds light on what is happening if the woman instead turns to a well-funded Whole Life policy. By obtaining the $25,000 from a policy loan, she doesn’t need to “draw down” any of her other assets, and even her life insurance policy continues to chug along (subject to the technical caveat about “direct recognition” discussed in endnote 2). This is what fans of IBC have in mind when they warn people that “paying cash” for car purchases and other major expenses means that they will lose out on the ability to continue earning interest on their savings.

Before leaving this section, let me address one loose end: If I can use an example of a home equity loan to illustrate the broad principle, why then do IBC fans insist that “there’s nothing else like this” in the financial world? Why not, for example, just tell people to use home equity financing rather than building up a Whole Life insurance policy?

The crucial difference is that the real estate market could collapse. This is why a commercial bank will not grant home equity lines on the same terms that a life insurance company will use for a policy loan. In particular, if you apply to a bank for a home equity loan, it is a laborious process, where the bank will check your credit score and your income, it will ask what you are doing with the loan, and it will insist on a timely repayment schedule. The life insurance company does none of this. They simply check what your unencumbered cash surrender value is, in order to determine how much of a policy loan you can borrow.

The check can literally be in the mail the next business day, and—to repeat—the life insurance company doesn’t care what payback schedule you adopt, if any.

In light of these considerations, we can understand the enthusiasm of the fans of IBC, and why they insist that there is no other financing mechanism available that can match the process developed by Nelson Nash.

DON’T FORGET ABOUT POLICY LOAN INTEREST!

Before closing this article, it is important for me to address the issue of policy loan interest. It would be very misleading to tell the public about the virtues of constant compounding without keeping track of the corresponding liability due to the policy loan.

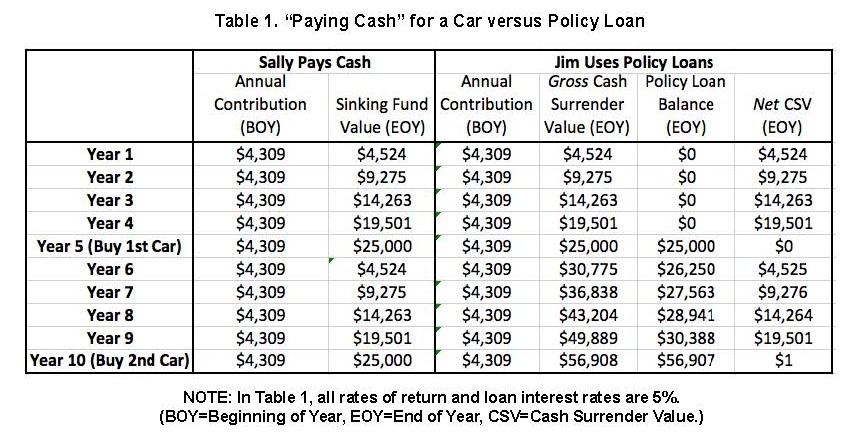

The best way for me to illustrate the problem is to contrast Sally, who is going to “pay cash” for a car using a sinking fund, with Jim, who is going to take out a policy loan from a life insurance policy. In this example, we will see the familiar point that IBC fans make about “lost opportunity cost” when paying cash, but we will also see how the policy loan growth offsets the apparent gain of the IBC approach.

In order to minimize the number of moving parts, I am going to assume that Sally earns 5% on her sinking fund, while Jim enjoys an internal rate of return (counting dividends etc.) on his cash surrender value of 5%, and that the life insurance policy loan interest rate is 5%. In reality, these numbers may all be different, of course, but my example should help financial professionals and the public to refine their understanding of what factors are actually driving particular wealth outcomes from different strategies.

There’s a lot going on in Table 1, so let’s first concentrate just on Sally. By assumption, she has a sinking fund (composed of bank CDs, for example) that earns an internal rate of return of 5%. She wants to buy a new car for $25,000 at the end of Year 5. In order to achieve this goal, Sally puts $4,309 at the start of each year into her sinking fund. By the end of Year 5, her sinking fund has grown to a value of $25,000. She cashes in her CDs and pays cash for her new car.

She repeats the whole process starting in Year 6. Because she had cashed out her fund the prior year, notice that the sinking fund is only worth $4,524 at the end of Year 6—the same as at the end of Year 1. There is no “memory” in her sinking fund of her earlier contributions; she starts the cycle anew with each car purchase.

Now look at Jim’s figures. We assume that he makes the same out-of-pocket contributions as premium payments into a Whole Life insurance policy. To keep things apples to apples, we are unrealistically assuming that there is no overhead and that all of the payments immediately become available as Cash Surrender Value (CSV). We further assume that with dividend reinvestment etc., the CSV of this policy grows with an internal rate of return of 5%.

For the first five years, the two approaches are identical. That is, the market value of Sally’s sinking fund and the CSV of Jim’s life insurance policy are the same. However, things diverge at the end of Year 5, when they make their first car purchase.

At this time, Sally wipes out her portfolio of bank CDs, in order to buy the $25,000 car. She has no debt, but she also has no financial assets. She has a brand new car, but financially she is back to $0 and has to start rebuilding from scratch.

In contrast, Jim’s gross Cash Surrender Value is not affected by the fact that he takes out a policy loan of $25,000. He keeps making his premium payments, and his policy keeps chugging along, growing at an internal rate of return of 5%. By the end of Year 10, Jim’s life insurance policy has grown to a gross cash value of $56,908, whereas Sally’s bank CDs have only recovered to their previous high of $25,000—and they are just about to get knocked back down to $0 when she buys her second brand new car.

I believe this contrast—between the value of Sally’s sinking fund and the gross Cash Surrender Value in Jim’s life insurance policy—is what the typical IBC proponent has in mind when he teaches people the importance of “keeping your money working for you” and how paying cash “ignores opportunity cost.” This is all true as far as it goes.

However, we must also take into account a very important fact: If Jim is devoting the same out-of-pocket cashflow as Sally into his life insurance premiums, then he has no extra cashflow to pay down his policy loan. After all, the reason Jim has the luxury of “keeping his money in his life insurance policy” when he buys the new car, is that Jim gets the $25,000—at the end of Year 5 and then again at the end of Year 10—by borrowing from the life insurance company.

Once we account for this extra cashflow and the liability it brings, we see that Jim’s net Cash Surrender Value—which is the gross CSV minus the outstanding policy loan balance—leaves him in basically the same position as Sally. Yes, it is certainly true that Jim enjoys constant compounding on his cash values that “stay in the policy,” but these are offset by the constant compounding on the policy loan balance. In this example, I made all of the rates of return identical, so that the two forces perfectly offset each other. But even if the various interest rates are different (which they will be in the real world), the concept is still crucial. It would be an incomplete account of what is happening, to mention only the gross cash value and ignore the offsetting policy loan balance.

FINANCING THROUGH IBC IS A GOOD IDEA

I want to stress that I am a huge proponent of Nelson Nash’s IBC, especially in our volatile economic environment. The principles Nelson teaches in his book are valid, and his numerical examples were based on real-world illustrations generated by home office software with interest rates that held when he wrote his book.

The simplistic example I discussed in Table 1 above was not intended to show the reader that “it’s all a wash.” On the contrary, I think it makes much more sense to finance large purchases using the IBC approach, rather than (say) building up a sinking fund through bank CDs, commercial savings accounts, money market funds, or other popular and “safe” assets. (For example, the combination of safety and after-tax yield afforded by a life insurance policy compares quite favorably to these other possibilities, and you get the kicker of a large death benefit.)

Furthermore, I think the fans of IBC are correct to stress to the public the virtue of “constant compounding” that is afforded by a dividend-paying Whole Life insurance policy. (For example, the “historical average rate of return” that is touted for the stock market can often mask years when losses occurred, giving a very misleading picture of what would really happen to your money in such investments. In contrast, you don’t need to worry about your cash value going down during a “bad year” with life insurance.)

So rather than pooh-poohing the advantages of IBC, the purpose of my example in Table 1 was simply to make sure the public is presented with the full picture. I definitely agree that in practice, someone who uses a sinking fund approach and adopts an “always pay cash” mentality will not end up as wealthy as someone who adopts the IBC approach.

Yet as the figures in Table 1 reveal, the reason for the superior wealth accumulation under IBC isn’t merely the fact that “you lose the opportunity to earn interest on your savings” when you pay cash. By itself, that consideration is counterbalanced by your need to take out a loan (growing exponentially) when you keep your money at work in a policy. There are other reasons that IBC is superior to paying cash, including the very real psychological tendency for people to “find more money” to pay down an outstanding policy loan. Another motivation is their willingness to divert large flows of cash into an IBC-structured policy when they see how large the death benefit jumps, even if it is partially offset by a growing policy loan balance.

CONCLUSION

All things considered, Nelson Nash’s Infinite Banking Concept (IBC) is an ingenious process of managing cashflows using a dividend-paying Whole Life insurance policy via policy loans. It is a very robust strategy that is superior to more traditional methods of finance, including the conservative approach of “paying cash” and avoiding all debt.

In the world of IBC, it is standard to teach newcomers the importance of opportunity cost, and to show that IBC allows your money to enjoy constant compounding. These principles are all correct, and the lessons are important. However, as I’ve shown in this article, evangelists for IBC should be clear to include the offsetting liability of a policy loan balance in their more elaborate discussions. This will provide the public with a full and accurate picture, so that they will hopefully see the superiority of IBC and embrace it in their own households and businesses.

References

1. Episodes 17, 18, and 19 of the Lara-Murphy Show are available at: https://lara-murphy.com/podcast/page/3/.

2. Strictly speaking, certain life insurance companies follow the practice of “direct recognition,” in which case the size of the dividends generated by the policy (and hence its “internal rate of return”) could be reduced by outstanding policy loans. However, that is a technical issue regarding how fast the policy grows, and even here, it is not correct to think that the policy loan “comes out” of the life insurance policy.