I published this article in November 2010—right at the time that Bankruptcies were at an all-time peek for Americans as well as Canadians. However, even today in 2023, the filing process, except for a few things, remains the same. But knowing the differences according to the Bankruptcy code in America and also Canada, is important to understand, especially if you are interested in getting into a lucrative business. Therefore this article is worth reading once more.

If you are an IBC practitioner truly understands how these policies function, the current environment creates an ideal situation for you to make the safest loans you can possibly make to small businesses that need cash. Look into becoming what I did for years – a Debtor in Possession, otherwise know as DIP Financing. [In this article an IBC practitioner is a reference to a layperson practicing IBC, not to be confused with an Authorized IBC Practitioner.]

L. Carlos Lara

As the recession deepens, more businesses, as well as individuals, will file for Chapter 7, Chapter 13, or Chapter 11 of the United States Bankruptcy code. Generally, a Chapter 7 is a straight liquidation of assets in order to distribute the proceeds to creditors. A Chapter 13 is designed for individuals and is a long-term creditor repayment plan. A Chapter 11 is a re-organization of a business under bankruptcy for purposes of making possible its continuation as a profitable entity.

Bankruptcies are up 11% over last year with more than 1.2 million cases filed in federal courts during the first nine months of 2010. Some states, like California and Florida, are up as much as 81% over last year! (1.) This is especially noteworthy because bankruptcy filings had actually fallen in 2006 after Congress made it harder for debtors to avoid repaying creditors. However, the numbers have been steadily rising since the economy weakened in 2008. (2.) Now as we enter 2011, these numbers are expected to increase as unemployment and the cost of living also increases. However, the numbers will most likely explode if interest rates start to rise. Most Austrian economists are predicting that they will.

The statistics reveal that the vast majority of these cases have been consumer filings. Out of the total 1.2 million bankruptcies filed, only 43,016 have been businesses. This number could be somewhat misleading if you take into account that some of the individuals who filed for bankruptcy may actually have been small business owners, as many businesses aren’t structured as corporations. In bankruptcy, a corporation does not put the personal assets of the shareholders at risk, except for the value of their investment in the company’s stock. Alternatively, a sole proprietorship does not have an identity separate and apart from its owner(s). A bankruptcy case involving a sole proprietorship includes both the business and personal assets of the owner-debtors. Similarly, partnerships are like corporations and do exist distinctly separate from its partners. However, the partner’s personal assets may be used, in some cases, to pay creditors, or the partners themselves may be forced to file for bankruptcy protection. (3.)

Ironically, bankruptcy is often referred to as “protection.” The truth is that bankruptcy courts (generally) provide people, or businesses who can no longer pay their creditors, a structured means for liquidating their assets. In actuality, they provide time that is free from creditor pressure to formulate a repayment plan. When under pressure from demanding creditors, this time element becomes invaluable. Nevertheless, bankruptcy is not really protection, nor is it a safe place to enter, especially if the individual, or business still has a lot of assets.

Statistics show that most small businesses rarely emerge from Chapter 11 bankruptcy; the success ratio for even the larger corporations is less than 10%. In fact, the sad truth is that most Chapter 11 bankruptcy cases wind up as Chapter 7 liquidations.

Bankruptcy, however, is big business. If the business bankruptcy cases are large, meaning that they have lots of assets, they become a huge money banquet for predatory bankruptcy attorneys, U.S. bankruptcy trustees and especially banks. Like birds of prey that circle a wounded animal, these financial players of the bankruptcy courtroom feed off the assets of a distressed business, leaving it completely gutted and unable to survive. It should come as no surprise that this type of financial activity can only happen on the government’s turf. Federal courts are the only courts that have jurisdiction over bankruptcy cases, a fact confirming that bankruptcy is anything but a safe haven of protection. If you are facing this possible dilemma, or know someone who is, make absolutely sure no other options are possible before filing for bankruptcy. The advisors you use should be knowledgeable specialists in this arena, having only yours or your client’s best interest at heart.

Is there an alternative?

The good news is that there is an alternative solution for businesses in financial trouble — there is no need to file for bankruptcy. Utilizing this alternative will avoid the careless depletion of assets, and dramatically increase the chances for business survival. This alternative is known as the “Informal Reorganization.” Everyone should become familiar with its process, especially financial representatives, attorneys, or accountants who are always speaking to people about their money. The deepening recession invariably will present situations calling for this type of assistance; you should be ready to access, or provide this alternative to bankruptcy.

The informal reorganization will also be of particular interest to the IBC (Infinite Banking Concept) practitioner who, as a bank, can provide an invaluable financial service and actually assist in the rehabilitation of a business. For those willing to try their banking skills in this highly specialized area, this work-out formula is a win-win solution for debtors, creditors and new lenders. As this article is intended to demonstrate, the IBC practitioner (the new lender) can be very well compensated for the use of his money.

How it works

To understand the dynamics of this creative process, it is important to first walk through the various stages of a typical Chapter 11 bankruptcy case in order to become better acquainted with the players and their motivations. As a beginning point, we should note that all businesses in financial trouble have one thing in common. They are businesses that have simply run out of credit and money. Without operating capital, and more importantly credit, a snowballing effect of money problems will quickly and seriously threaten the life of the business. If the business does not receive a new infusion of capital, followed by the re-opening of its credit lines, the business will begin cannibalizing its own assets in its attempts to stay afloat. When creditors become aware of this asset deterioration they will seek to force the business into a controlled liquidation environment, which is an “involuntary” Chapter 7. This is a situation where two or three creditors can actually push a company into bankruptcy with the sole intent of liquidating the business quickly. The quicker the liquidation, the more there is to distribute to creditors before the assets are totally depleted. If the business owner is unaware of the bankruptcy alternative (the informal reorganization), this mounting pressure will force the business owner to file ahead of creditors and obtain a Chapter 11, which provides debtors the ability to formulate a plan of reorganization to keep its business alive and pay creditors over time. In addition to this, the 180 days, which are given to the business owner by the bankruptcy court to formulate the plan, also provides essential time to identify and obtain a new lender.

Once the Chapter 11 filing has been submitted and approved by the federal bankruptcy court, all creditors are immediately sent notices of the filing. This means that creditors can make no further demands upon the business. In other words, all collection efforts stop and all executory contracts with the business become null and void. As a protective recourse, unsecured creditors will immediately form a “creditor’s committee” made up of the seven largest creditors of the business for purposes of creating a unified voice in court hearings. It is important to realize that next to the debtor (the business owner), the unsecured creditors (generally the trade suppliers) stand to lose the most once a business files for Chapter 11 bankruptcy. Conversely, the secured creditor, usually a commercial bank, is first in line to the proceeds from the assets of the bankrupt estate.

As the business owner, now the “debtor in possession” (DIP) under Chapter 11, begins to use, sell, or lease the assets in the normal course of business, the fight over the proceeds becomes the most crucial aspect of the entire bankruptcy case. While this battle ensues in the courtroom, the debtor is in constant search for new funding. He absolutely must secure this new money or face termination, but who will lend to a bankrupt business? Having lost credibility with creditors, the debtor faces an even bigger challenge in re- opening its credit lines.

As the case moves forward, bankruptcy expenses rise exponentially and soon become crippling. Burdened by additional bankruptcy expenditures and still own terms. Interest on these DIP loans can run as high as 20%, rates normally seen on credit cards, with a complete repayment of their loans in two years to be made ahead of everyone else. This is obviously a very secure and highly profitable form of lending, and all made legal by the U.S. Bankruptcy Courts! (4.) attempting to operate without working capital, the business’s chances for survival dwindle. By federal law, the debtor must pay the U.S. bankruptcy trustee a fee out of cash flow calculated on the amount of quarterly business disbursements. Depending on the size of the bankrupt estate, fees can easily run in the tens of thousands every quarter. Additionally, legal and accounting fees, which are also paid out of cash flow, are very expensive. Yet the primary ingredient to get the reorganization plan off the ground, which is new funding for operating capital, often remains unobtainable. If it is a small business, the chances for obtaining new funding are nil. (In bankruptcy, debts totaling less than $2.1 million are considered a small business) For this reason, the majority of Chapter 11 cases wind up being converted to Chapter 7 liquidations and only the court-approved legal professionals, the U.S trustee and the secured creditor win. Everyone else loses.

DIP Financing

As we can see, businesses filing for bankruptcy need loans to work out their troubles, or face liquidation. In the early eighties, some of the largest banks such as Lehman Brothers, Merrill Lynch, JP Morgan Chase and GE Capital began to meet this need and pioneered a new form of lending designed especially for large companies filing for Chapter 11 bankruptcy called “DIP Financing.” By making use of what proved to be a very advantageous federal bankruptcy law, these lenders created enormous profits for themselves by lending to distressed businesses in bankruptcy. That law, in effect, provided lenders court approved “superiority” over all other secured and unsecured creditors, and also gave these special lenders a priority lien on the property of the bankrupt estate. This window of opportunity made it possible for new lenders to become involved in the bankruptcy process as saviors and virtually name their own terms. Interest on these DIP loans can run as high as 20%, rates normally seen on credit cards, with a complete repayment of their loans in two years to be made ahead of everyone else. This is obviously a very secure and highly profitable form of lending, and all made legal by the U.S. Bankruptcy Courts! (4.)

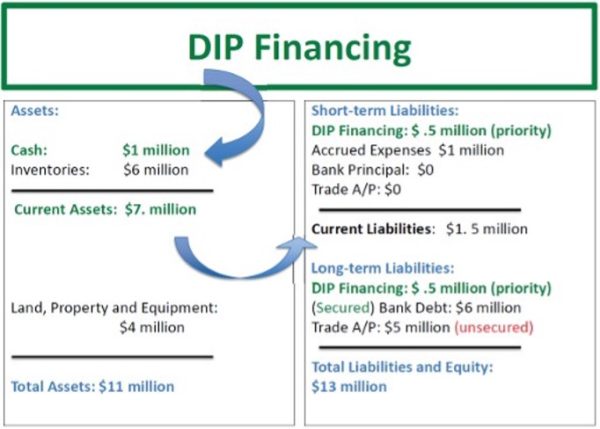

For example: Assume a business in bankruptcy has assets equaling $10 million made up of $6 million in inventories and $4 million in land, property and equipment. On the liabilities side, it has $7 million in short term liabilities (liabilities payable within 12 months) consisting of accrued expenses, principal payments to the secured lender and $5 million in trade (suppliers) accounts payables. Long-term liabilities consist of a $5 million note payable, maturing in 4 years, to a secured commercial bank who also has a lien on all the assets of the business. See diagram A.

Diagram A.

The business is obviously insolvent. If we apply a current asset to current liabilities ratio test (the acid test), we easily calculate a $1 million working capital deficit and can, therefore, determine the size of the emergency loan requirement. This is where DIP Financing comes in. See Diagram B.

Diagram B.

Already one can start to visualize the potential opportunity that exist for these DIP Financing firms, but take note, they seldom save businesses.

As we have already stated, their track record is dismal. The reason for these results is because saving businesses is not really their main purpose. After their initial infusion of capital, there is still so much that must be accomplished. Existing creditors must still decide whether or not to resume extending credit to the bankrupt business; a hard decision to make when a company is in bankruptcy. What these DIP banks do very well is make good loans. These types of loans make big money and pay back the principal, fast. Making money is clearly their primary objective and the bankruptcy environment makes it all possible.

The Informal Reorganization

An informal re-organization, on the other hand, provides several important benefits not found in bankruptcy with the first benefit being that the rehabilitation of the business is the primary objective. Once the original parties involved (the debtor, creditors and the lender) determine that the business has a reason for continuing, rehabilitating the business becomes a co-operative effort by everyone from the beginning. Even though reorganizing the company will involve restructuring the debt over a period of time, the goal is for all creditors to be paid 100 cents on the dollar. Everyone works together in order to protect their investment and their investment resides in the future of the business as an on-going entity.

Make no mistake; this is a highly specialized process. For this reason, the business owner must begin by first hiring a qualified consultant with expertise in this area. A qualified informal reorganization specialist will be able to conduct a fast study of the business and asses its viability. Immediately following this analysis, the specialists will negotiate “stand still” agreements with creditors for a limited time (equivalent to the 180 days in bankruptcy) in order to raise immediate cash through the sale of stagnant assets, structure bridge loans, develop budgets and expense controls, and access new long-term funding for the business. This new money can come from several sources and will depend on the size of the business. Unlike the obstacles placed on small businesses in bankruptcy, in these types of cases there are no dollar limits; small businesses are prime candidates. For that reason, the sizes of loans are often much smaller. In fact one, or a group of IBC practitioners, could easily fund such business reorganizations.

These plans are very safe, especially for the lender and mirror the bankruptcy scenario. They are much more likely to succeed because they are so much less expensive to construct and everyone is pulling toward the same common goal. Like the DIP loans, loans made in an informal reorganization are “superior loans” and are paid ahead of everyone else. This is why it is important to examine the similarities of the out of court reorganization to those attempted in bankruptcy. But, just exactly how these plans are specifically structured and the details of the security provided the lender in the informal reorganization, will be the subject of part two of this article in our December issue of the Lara-Murphy Report. If you want to become a banker, you will not want to miss next month’s issue.

Bibliography

- The Los Angeles Times, http://articles.latimes.com/2009/dec/22/ business/la-fi-smallbiz-bankr…

- The Washington Bureau, http:/www.bizjournals.com/extraedge/washingtonbereau/archive/20, November 9, 2010

- Federal Courts, http: uscourts.gov/FederalCourts/BankruptcyBasi… November 10, 2010, 5:47 AM

- The New York Times, http nytimes.com/2009/02/19/business/19dip.htm, February 8, 2009