Content: Page 26 Becoming Your Own Banker Fifth Edition

YOU “FINANCE’ everything you buy. You either pay interest to someone else or you give up interest you could have earned.

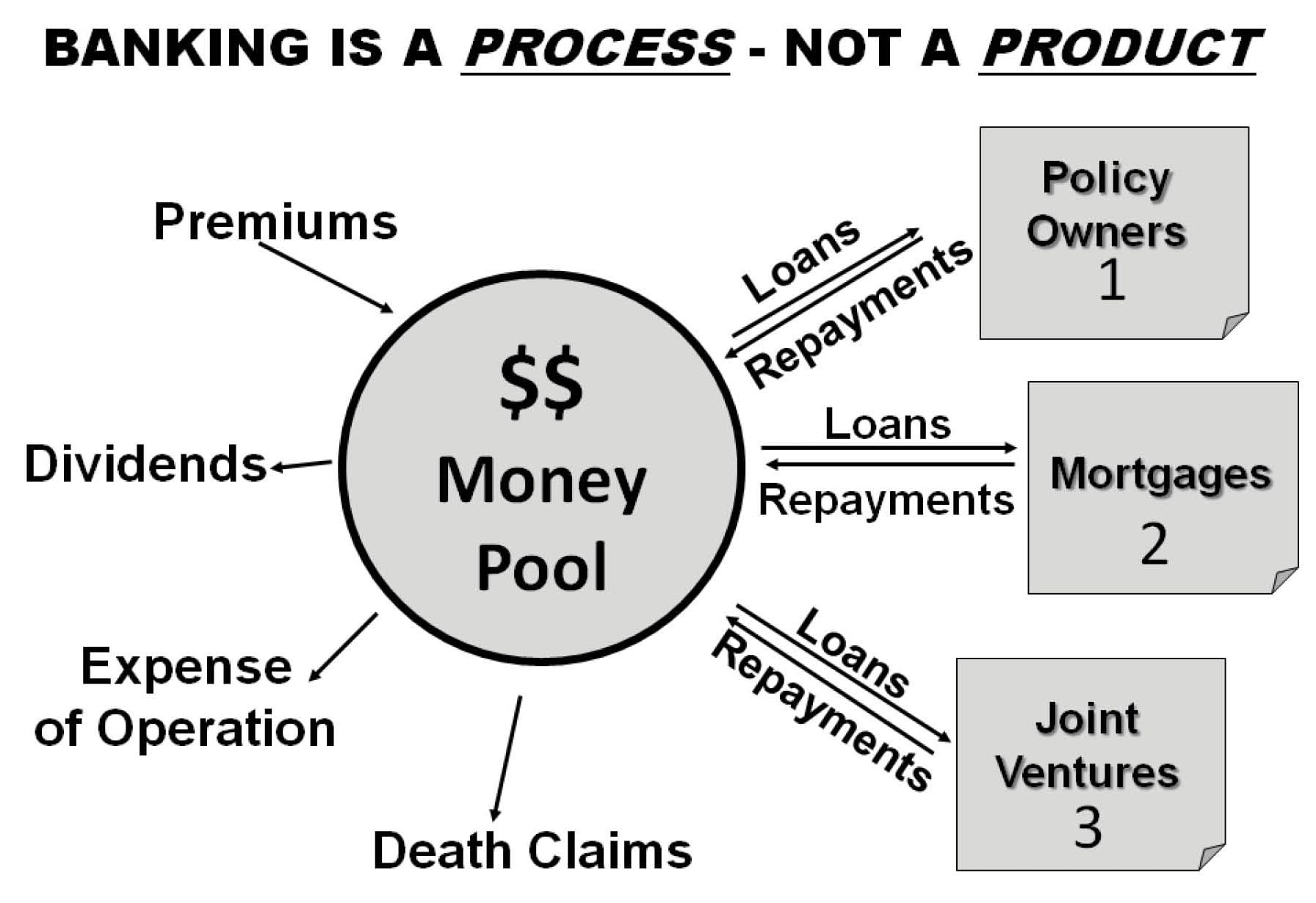

CREATE AN ENTITY— A plan — which you control and it makes money on your loans. One such entity can be a life insurance plan. Life insurance companies hire actuaries who design plans of insurance and then market those plans through agents. When someone buys one of these plans, the contract is very specific to point out who owns the plan (or policy). It is not the insurance company! The company is simply the administrator of the plan and must collect premiums—and must lend money out or make investments of one kind or another in order to be able to pay the death claims promised. Money is lent to any number of places and types of borrowers, including the owner of the policy if the owner so desires. The amount of money available to the owner is the entire equity in the policy at the time. In the hierarchy of places where money is lent, the owner ranks first. That is absolute CONTROL!

At the end of the year, the Life Insurance company makes an accounting of the experience that year of the death claims paid, the earnings on premiums collected, and the expenses of running the company. A dividend is declared which is actually a return to the policy owner of surplus premium that was collected. Hence, it is not an earning and, therefore, is not taxable. When that dividend is then used to buy additional paid-up insurance at cost, then the result is continuous compounding of an ever-increasing base.

It looks like this diagram: