Content: Page 38, Becoming Your Own Banker Fifth Edition

Content: Page 38, Becoming Your Own Banker Fifth Edition

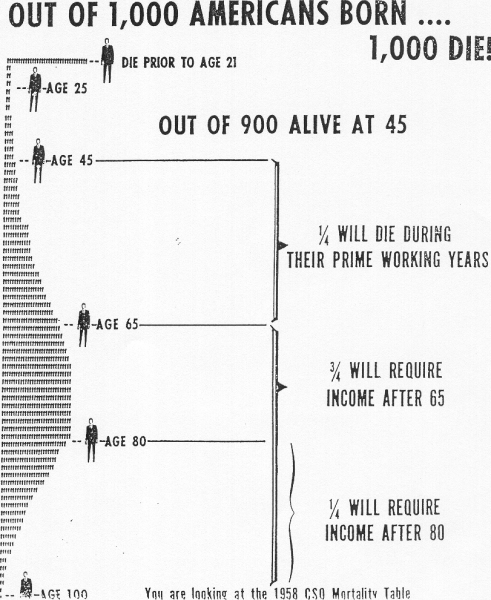

In studying the mortality chart in the previous lesson, notice that out of the 900 living at age 45, seventy-five percent of them were still alive at age 65. This clearly shows that most all of the dying in a population group occurs past age 65. In fact, that bulge in the graph has shifted dramatically downward in recent years to the point where most all of the dying occurs past age 75. There are many reports of the potential for living 100 to 120 years! But in the everyday conversations about the “need” for life insurance, it is all concentrated on the period of age 21 to about age 50. Not many people die during this period.

In creating plans of life insurance, all calculations by the rate makers begin with the cost, in a single sum, of providing a plan that would cover one for the whole of life. It is called single premium life insurance. It is possible to buy life insurance this way, but it is not a common occurrence.

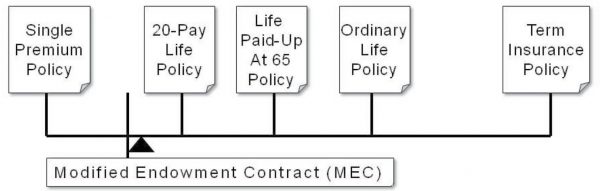

The diagram on page 38 of my book is a continuum that depicts all the different purchase plans. On the left end of the scale is the aforementioned single premium policy. The balance of the plans consists of nothing more than time-payment plans for purchasing the single premium one. On the extreme right is term insurance. In this plan you are simply renting the single premium insurance for a limited period of time with an option to a time-purchase plan.

If one goes the route of term insurance it must be remembered that, with time, the price is going to get prohibitive, not to mention the fact of becoming uninsurable. Please, also remember that this is the way life insurance started out and the buying public accurately observed that this – in the long run – was a rip-off! If this doesn’t register in your own mind, then go back and review lesson 20 one more time. If it still doesn’t register, then you need to consider terminating your study of this course – you may be wasting your time!

Looking at the plans between the extremes of single premium insurance and term insurance, consider the Ordinary life Policy. This is a purchase plan with premiums designed to be paid over the theoretical life span of 100 years. So, if the insured is 25 years old, then this would be a 75-pay plan.

Looking at the plans between the extremes of single premium insurance and term insurance, consider the Ordinary life Policy. This is a purchase plan with premiums designed to be paid over the theoretical life span of 100 years. So, if the insured is 25 years old, then this would be a 75-pay plan.

The payment period could be shortened by buying a Life Paid-up at age 65 plan. For this same 25-year old that would be a 40-pay plan. It could be further shortened to a 30-pay plan or a 20-pay plan. The shorter the payment period the better suited it is for the purposes of the Infinite Banking Concept.

Now, notice the vertical line between the Single Premium policy and the 20-pay Life policy with the triangle at the bottom of the scale. Any plan located to the left of this line is classified as a Modified Endowment Contract (or MEC). Those plans are not treated as life insurance by the IRS, meaning that any withdrawal or loan from the plan would be treated as a distribution and would be taxed as from any other accumulation account, i.e. part is capital and part is earnings. The earnings portion is taxed as ordinary income in the year the withdrawal or loan is made.

This is not an earth-shaking matter, but it can be avoided with a little bit of understanding of just what is going on. So, why bother with getting on the left side of the MEC line. After all, we are not attempting to accomplish all of the banking needs through the device on one policy – we will need a system of many policies in order to do the complete job.

This is just a description of the design for each policy to best accomplish the system.

When using this type of life insurance to solve your need for banking, it is best to select a plan (the base policy) that is in the middle of the scale (such as ordinary life or a life paid-up at age 65) and then add a Paid-Up Additions Rider (PUA) to the plan. By varying the amount allocated to each portion you can place the resultant policy at any point between the base policy and the MEC line. The whole idea is to “snuggle up to the MEC line – but don’t cross it!” This will de-emphasize the initial death benefit but accentuate the banking qualities (the cash values).

The irony is that doing it this way will result in providing more death benefit at the point where death will probably occur than any other plan. The base policy will pay dividends and the Paid-Up Additions Rider will also pay dividends. These all should be used to buy Additional Paid-Up Insurance, which gives more meaning to the infinite qualities of the system.

In understanding this lesson, one must be aware that the home offices of life insurance companies come up with cute little names for their policies, but all of them fall somewhere on the scale that we studied here. I don’t know why they do this but if one can cut through all that stuff and realize what is happening, it really simplifies life!

In the next lesson we will look at a couple of cases that dramatize what we have learned in this one.