A case study on how to transform accumulated financial value into seed funding for your own personal monetary system

by Ryan Griggs

Background

Meet my client Dave (no, it’s not his real name).

When we met late last year, Dave was about 50 years old. He’s a successful tradesman who had built a substantial business. Dave was recently approached with an offer to buy his business, and as a result, Dave expected to have about $2,000,000 that he wanted to use to establish his own personal monetary system the way Nelson Nash teaches in his book Becoming Your Own Banker.

Ah, but we immediately encounter an obstacle.

It’s impossible to pay a single premium to a whole policy and retain the preferable, non-MEC tax status ordinarily afforded to whole life insurance.

The case study that follows is (an approximation of) the solution I built out for Dave, an application for which is currently in underwriting. I recreated the case with slightly different numbers (age included) to protect Dave’s privacy.

Though the case concerns the use of funds from the recent sale of a business, the principles it exemplifies apply in all cases where an individual may want to use a single lump sum as what is essentially seed-funding for one’s own personal monetary system.

This “lump sum” or windfall of money could come from a variety of sources: the sale of real estate, an artistic (e.g. music) portfolio, a business; inheritance; you name it. It just so happens that this in this case we’re talking about the sale of a trades business.

We’ll review the mechanics of the specific contractual feature we use to accommodate this sort of case; explore the structure and design of the contract; take a look at how future cash value growth illustrates given the current experience of the company; compare to alternative deployments of large windfalls; and wrap up with some final thoughts.

The Premium Deposit Fund Rider

A Premium Deposit Fund Rider, or PDF Rider for short, is something like a way-station or staging ground for future premium offered by most companies that sell dividend-paying whole life insurance.

Like other features of whole life insurance, the terms and conditions governing a particular PDF Rider will vary company to company. In general, a PDF Rider will accept a certain number of years’ worth of maximum allowable premium in a given year. Some PDF Riders have to be funded at issue, meaning when the policy is originally offered for delivery to a new policy owner. Others can be funded some time after initial delivery.

If a policy owner has chosen to pay money to a PDF Rider, then as future Policy Anniversaries come around, the life insurance company will automatically draw money from the Rider to pay scheduled premium.

In a sense, funding a PDF Rider is a way of putting some future premium payments “on autopilot.” For instance, in the case below, we’ll consider a PDF Rider funded at issue (that is, on Day One of the policy) with $2,000,000. When this policy is approved for delivery, Dave will pay the company $2,000,000 right up-front. The life insurance company will immediately take some of the $2,000,000 to pay the first year premium. The remainder will be allocated to the PDF Rider, from which future premiums will be paid. In this example, we’ll assume that the PDF Rider pays premium for ten policy years.

What happens to the PDF Rider balance between Policy Year One, Day One of the new policy and future Policy Anniversaries?

I won’t speak to how all companies treat their PDFs, but in Dave’s case, the balance in the PDF Rider is perfectly liquid and guaranteed by the life insurance company. In other words, if Dave later changed his mind after the policy went in force and he wanted to withdraw his PDF Rider balance, he could. And at this particular company, there is no charge for doing so.

Should Dave leave the PDF Rider balance alone (this is the plan), then we get a special benefit when future policy dates come around. PDF Rider money at this particular company pays future annual premium at a compounded interest-equivalent discount, which in Dave’s case is 5%.

Now just what the heck is a “compounded interest-equivalent discount?”

It helps to explain by way of contrast.

What does not happen in this particular PDF Rider is any form of interest accrual. It’s not as though the company is keeping track of daily-accruing interest based on a declared rate and daily balance and then adding that accrued interest to the Rider balance at the end of the year. This isn’t a savings account or CD.

Instead, what happens is the Year Two Policy Date comes around, $1 of PDF Rider money will pay $1.05 of scheduled premium. This is what the “discount” part of “compounded interest-equivalent discount” means. More premium is considered paid than is subtracted from the PDF Rider balance.

The effect of this discounted premium payment is treated like interest for tax purposes. If $1,000 of PDF Rider money pays $1,050 of premium at the beginning of Policy Year Two, then the policy owner receives the equivalent of $50 of interest income. The policy owner receives documentation from the company at the end of the calendar year notifying him of the precise magnitude of what is effectively interest income for tax reporting purposes. This is what the “interest-equivalent” part of “compounded interest-equivalent discount” means.

At the beginning of Policy Year Three, and beyond, the amount taken from the PDF Rider pays premium at a compounded discount. That is, at the beginning of policy year three, $1,000 of PDF Rider money will pay more than $1,050 of premium. At a 5% (compounded) discount, the $1,000 of PDF Rider money will pay approximately $1,102.50 of the scheduled premium at the beginning of Policy Year Three. It’s as if the $1,000 of PDF Rider money grew at 5% interest compounded annually for two years. In reality, it didn’t, but the compounded nature of the discount generates what is essentially the same effect. This is what the “compounded” part of “compounded interest-equivalent discount” means.

The result of paying annual premiums out of a PDF Rider balance (at this particular company) is a systematically decreasing annual reduction in the PDF Rider balance and a systematically increasing portion of future scheduled premium paid at a discount.

To be clear, yes, this is effectively, though not technically, the same as “earning 5% compounded interest” on the annual premium each year on a guaranteed basis with the backing of a mutual life insurance company that’s over 100 years old. As we’ll discuss below, in the current banking environment, that’s fairly attractive. As you’ll see in Dave’s case below, it amounts to $466,670 over ten years in premium paid over and above what Dave will initially place in his PDF Rider. $2,000,000 goes into the PDF Rider, but $2,466,670 gets into the policy in the form of premium.

Other companies may structure their PDF Riders more intuitively. Similar to the “hold at interest” dividend election, a company may in fact credit interest growth on a PDF Rider in the same manner as a bank would credit interest growth to an initial balance on a Certificate of Deposit (CD).

Why companies structure their PDF Riders differently is the subject of pure speculation. However, with the compounded interest-equivalent discount method, one might notice the effect on tax liability over time. Since the magnitude of premium payment attributable to the discount increases over time (due to compounding), tax liability is distributed over time in a manner that mirrors cash value growth. That is, if the discount is treated as interest income and the effect of the discount compounds over time, then the amount of interest income received (and taxed) increases over time too. This mirrors the compounded growth trajectory of cash value.

In contrast, with the more simpler, bona fide interest-accumulation structure, tax liability is greatest earliest, since interest growth will be greatest when the PDF Rider balance is greatest, i.e. in the First Policy year.

If one expects to pay interest income tax via policy loan, one might prefer a pattern of interest income tax liability that mirrors the cash value growth trajectory (as occurs with the compounded interest-equivalent discount method) as opposed to the inverse, where tax liability is greatest when the policy is youngest and cash value growth is slowest (as with the simpler interest accumulation structure).

We should point out, though, that with either PDF Rider structure, there will be more than sufficient cash value growth to allow for a policy loan to pay the interest income tax. Even still, practically speaking, a policy owner is much more likely to pay interest income tax out of ordinary cash flow anyway.

Let’s summarize the reasons one might use a PDF Rider:

- You want the guaranteed safety and principal protection offered by a very old mutual life insurance company;

- You want guaranteed, perfect liquidity so that you can get the remaining balance of the PDF Rider back out if you had/wanted to;

- You want to get into the “banking” business and want to use a recent windfall to do so while still preserving preferable non-MEC tax status;

- You want to put a certain number of years of future premium “on autopilot;”

- You want to enjoy the benefit of the compounded interest-equivalent discount (or bona fide interest accumulation) between now and the exhaustion of the PDF Rider.

For an individual who either recently experienced an unusual, significant windfall, or has accumulated substantial financial value in another asset class over time, where the magnitude of the funds available is high relative to on-going cash flow, the PDF Rider is a tremendous option to consider.

Why do I say “where the magnitude of the funds available is high relative to on-going cash flow?”

The answer is that if the amount of available, accumulated financial value or windfall is similar to the expected, on-going level of cash-flow, then a PDF Rider may not be the best option.

Recall that Dave has $2,000,000 from the sale of his business to pay to his PDF Rider. What we haven’t talked about is Dave’s on-going income. Suppose Dave is accustomed to earning $4,000,000 per year in income, and can comfortably use $2,000,000 of it to capitalize his “banking” system, i.e. pay premium. In that case, $2,000,000 from the sale of a business is really just one year’s worth of his — hypothetically — appropriate premium. The PDF Rider wouldn’t even be effective, much less favorable, since the discount we’ve discussed only applies at the beginning of the second policy year.

In short, from the perspective of the IBC, a PDF Rider is a good fit for the individual who wants to move what for him or her is a lot of money relative to recurring incoming cash flow. After all, money allocated to a PDF Rider is not received as premium. PDF Rider money only enters the policy as premium on future policy dates. PDF Rider money cannot be borrowed against in the way one can borrow against cash value in a policy. Long time readers will recall that policy loans are available because the policy serves as collateral. The PDF Rider itself is just a rider, it is not a policy in and of itself; consequently, loans against it are not available.

Let’s touch on one last element pertaining to liquidity before taking a closer look at Dave’s case.

Moving a large sum of money is daunting. I get that. And yes, the guaranteed liquidity is nice, but we are setting things up so that PDF Rider money is supposed to pay premium over time. And there is some minimum, annual premium obligation (insofar as one wants to keep the policy in force). For instance, as we’ll see, Dave’s base and term rider premiums combined are $74,000 per year. That could be hefty, illiquid payment to cough up out-of-pocket, were Dave to liquidate his PDF Rider balance entirely.

But what I don’t want you to forget is that while PDF Rider money transfers into the policy over time, cash value is growing. This means that the amount of money Dave can receive in the form of a policy loan increases year to year. Put differently, it’s not as though the purchasing power embodied in his PDF Rider balance is inaccessible and useless so long as Dave keeps the money in the Rider. As we’ll see, Dave can get to approximately $180,000 by policy loan by the end of the first policy year. That’s a far cry from $2,000,000, but it’s not nothing, and the amount available increases in compounded fashion over time.

The point is that we have to think differently about what happens when we move a big chunk of money to a life insurance policy via a PDF Rider. It’s not like a conventional investment where we essentially neutralize the purchasing power of the transferred money. In fact, the whole point of Becoming Your Own Banker is to build up accessible capital. The PDF Rider is just a mechanism of granting a financial benefit, preserving preferable tax status, and providing guaranteed principal protection to a policy owner who decides to move what is essentially several years of future premium over to the company all at once.

Good IBC-style advising takes into consideration your expected needs for near-term future liquidity. In Dave’s case, the $2,000,000 available is not his gross profit from the sale of the business; not even close, in fact. Dave had other near-term liquidity needs, which we discussed and accounted for when determining how much of his gross proceeds he would use to get his banking system going (not least of which were taxes!).

The PDF Rider is not a sales tool to artificially inflate premium numbers. If you’re reading this thinking, “gosh this sounds like it might be a good fit for me,” you need to choose an advisor who can walk you through the technical specifics, explain liquidity in the policy, and help you select a funding level that takes into consideration your realistic liquidity needs. Getting into the banking business is a good thing, and using a large lump sum can be extremely helpful; but it shouldn’t be something that causes undo stress.

Case Design

Dave’s policy is an ordinary, dividend-paying whole life policy paid up at age 95. The premium structure is 30–70: approximately 30% of total annual premium pays base and term premium, and 70% pays PUA premium. The 30–70 structure is a function of Dave’s own choice, and age. Remember that Dave is 50. If Dave were 40, or even 30, I’d have more strongly encouraged a higher percentage of total annual outlay be allocated to base premium (I could explain why, but you’d get really irritated with how long this essay is).

I’m going to show you an iteration of this policy with a 20-year term rider. At Dave’s age, this qualifies as a long-dated level term rider. I spend at least an hour talking about term riders in my Whole Life Insurance Mechanics course on YouTube, so I won’t beat you down with the details here. But suffice it to say, Dave could go with a shorter-dated term rider, like a 10-year or 7–year rider.

In general, I’m for longer-dated term riders.

We use term riders to get death benefit up and away from cash value, so as to allow for on-going PUA premium payment for as long as possible, should the policy owner be willing and able to pay it down the road. Long-dated term riders do not obligate on-going PUA premium payment, they just help establish a death benefit that’s sufficiently high to allow for it (and for associated cash value growth!). Long-dated term riders can be dropped well before their stated duration. I’ll even get real wild and show you exactly what I mean in Dave’s case.

The point is that a long-dated level term rider establishes Dave’s authority to pay PUA premium from his own pocket in non-MEC fashion after the exhaustion of his PDF Rider money, should he want to.

In other words, we’re building in “banking room;” we’re giving Dave the right, but not burdening him with the obligation, to continue with out-of-pocket PUA premium payment. When Dave’s PDF Rider balance is completed exhausted after 10 years, Dave will be 60 years old. Dave has every intention of generating substantially more income then than he does even now, and has laid a lot of the groundwork to manifest that intention in reality. I expect Dave will need the ability to pay more PUA premium.

If we go with a shorter-dated term rider, and if Dave’s plans work out as he expects, or better, he’ll have to go back through underwriting to get a new policy (at a greater age!) to bring his total premium payment ability up to where it was during the first ten years in his original policy.

To my mind, why inhibit yourself from paying more premium, when with modest design changes, one could virtually lock in the right — without the obligation — to continue to pay more?

That’s why we assume a 20-year (long-dated level) term rider.

We take a 10-year PDF Rider premium payment time horizon. That is, the PDF Rider will pay premium for 10 policy years, after which the PDF Rider balance will be fully exhausted and the Rider will terminate.

The particular duration over which premium will be paid by the PDF Rider in this case is relatively incidental; in fact, this is relatively high number of years. The actual number of years of premium payment from the PDF Rider on Dave’s case is, in fact, different and for case-specific reasons.

Unlike the online marketeers, we assume good ol’ Average Joe, Plain Jane Standard Non-Tobacco underwriting status. The results you’ll see in the charts below do not rest on any glorious assumptions about the health status of a 50-year old tradesman and businessman.

There’s always a danger when showing examples. Especially with something so foreign as IBC-style whole life, folks tend to get caught up on particular numbers. I’ll tell you to not do that, to instead look at patterns and relationships since every case and every individual is different. Many of you will do it anyway. So when I say “specific results including policy structure, contract selection, rider selection, premium level, cash values, death benefits, underwriting status, and dividend assumptions, may and likely will be different in your case,” it may fall on deaf ears — but I’ll say it anyway!

Given the compounded interest-equivalent discount of 5%, Dave’s $2,000,000 PDF Rider balance will pay $246,667 per year in total, annual premium across base, term rider, and PUA rider premiums. $246,667 per year for 10 years is $2,466,670 in cumulative premium (i.e. cost basis) by the end of year 10, or 123.3% (!!!) of the initial Rider balance. This means that $466,670 of premium over ten years will be paid that Dave didn’t put there. This is the effect of the compounded interest-equivalent discount.

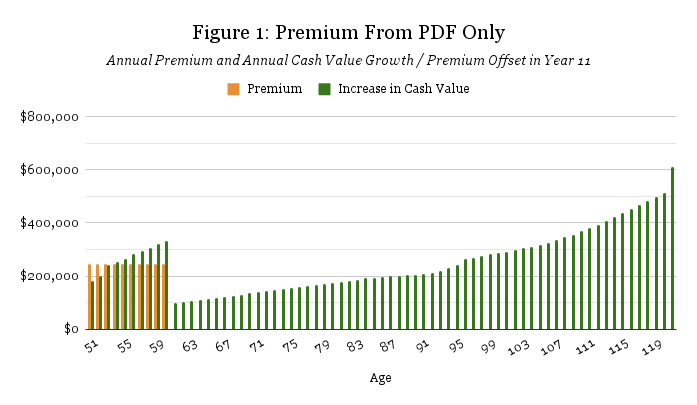

In the chart below, orange bars indicate total annual premium and green bars indicate annual cash value growth, or the increase in cash value in the year specified. Age is on the x-axis.

We’ll focus first on the more conservative premium funding scenario where Dave makes a one-time payment of $2,000,000 to the company, and no further premium payments of any kind thereafter for the life of the policy.

In Figure 1, I assume Dave will Premium Offset after year 10 in order to halt premium payments of all kinds after the exhaustion of the PDF Rider balance. This means that beginning in year 11 (age 61), we assume Dave no longer makes any PUA premium payment, and that base premium and term rider premium are paid via partial death benefit surrender. Prior purchases of additional paid-up death benefit, either from PUA premiums from the PDF Rider or from past dividends that went back into the policy via PUA premium, are essentially reversed. That is, premiums due in year 11 and beyond are “offset” via partial death benefit surrender (hence, “Premium Offset”).

Premium Offset isn’t super popular on the TikTok and YouTube displays of whole life insurance illustrations. Instead, to illustrate the assumption of no further premium payments, agent will often show the Reduce Pay-Up (or RPU) Nonforfeiture Option. As I discuss in the Mechanics series, RPU is a more severe, permanent change to a policy compared to Premium Offset. With Premium Offset, Dave could always decide not to offset premium with partial death benefit surrenders, and instead pay out-of-pocket. Doing so would give a relative boost to cash value growth, since an out-of-pocket premium payment does not cause a decrease in death benefit and cash value.

Let’s review some of the implications here.

First, as mentioned above, by using the PDF Rider, Dave got $466,670 in premium paid over 10 years that he did not send to the company. This is attributable to the compounded interest-equivalent discount applied whenever funds are taken from the PDF Rider to pay annual premiums.

Second, Dave’s created a value generation engine that will produce more and more contractually-accessible capital every year, for the rest of his life.

By age 80, Dave’s total cash value illustrates at $5,408,568.

By age 85, it’s $6,343,095.

By age 90, it’s $7,351,156.

Recall that Dave’s initial payment to the PDF Rider was $2,000,000.

Third, this cash value generation occurs in a tax-deferred, non-market-correlated environment. Only two assumptions back the figures in Figure 1: (1) that Dave leaves the PDF Rider balance alone and makes no withdrawals, and (2) that the company’s future experience continues unchanged.

Point (2) is obviously false. Future company experience will deviate from that at present, but since dividends are functions of future financial performance, and since no one can guarantee what will happen in the future, companies just assume that current experience continues into the future unchanged. This is why Nelson taught us to work with companies that actually have paid dividends for at least 100 consecutive years.

But the major implication here is that changes in tax policy and business cycle volatility will not interrupt this impressive growth pattern in the way they would with conventional financial assets. While others panic about the value of their 401(k) whenever there’s a business cycle downturn late in life (anyone paying attention to yield curves lately?), Dave will rest easy.

Fourth, Dave’s rising cash values will provide for a substantial, long-term, non-taxable passive cash flow late in life.

For instance, Dave could begin taking passive, tax-free cash flow from age 70 to age 90 at a rate of $150,000 per year, for total late-life distributions of $3,000,000 over the last 20 years of his life on a cost basis of $2,000,000 (these figures rely on the assumption of partial surrenders up to cost basis, followed by policy loans). In other words, Dave’s just generated a substantial late-life, tax-free cash flow, should he want or need it. Recall that Dave’s PDF Rider money represents only a fraction of the funds he actually earned on the sale of the business.

Fifth, between age 50 and age 70, prior to his hypothetical late-life passive cash flow time, Dave will enjoy significant access to capital in order to finance his lifestyle and productive business activities.

Total cash value is $1,140,562 at age 55; $2,677,121 at age 60; and $3,214,532 at age 65.

In fact, if Dave — who, you’ll recall, is a successful trades- and businessman — manages to create a cash flow that returns just 7% (net of tax) of cash value after only five policy years, he wouldn’t even need to deploy the Premium Offset after the exhaustion of his PDF Rider balance (7% of cash value of $1,140,562 at Policy Year Five is $79,839.34, which is more than the annual base and term rider premium of $74,000).

Put differently, in the context of our hypothetical, late-life passive cash flow example, Dave’s got 20 years to put his cash value to work via policy loan in order to generate cash flow that could (a) pay his on-going base and term rider premiums after his PDF Rider money is used up, or even (b) pay additional PUA premium in years 11–20.

To be clear, Dave doesn’t have to do any of this. He could pay his $2,000,000 at age 50 to the PDF Rider and “set it and forget it,” returning only to his policy at age 60 to instruct the company to Premium Offset and again at age 70 to start taking passive cash flow.

Sixth, let’s not forget death benefit.

By the end of the first policy year, we illustrate a death benefit of $3,835,708.

At age 55 it’s $5,233,967.

At age 60, it’s $7,168,953.

Dave will lose the death benefit associated with his term rider at age 70, and partial surrenders are literal decreases in death benefit. Even still, closer to natural mortality at age 75, total death benefit is still $5,196,366, well above where it started at age 50, and much greater than Dave would get had he used his $2,000,000 to, for instance, buy a deferred annuity (death benefit on annuities, if any, is typically limited just to the remaining, undistributed annuity balance).

Things get real wild when we consider a situation where Dave continues to pay PUA premium after the exhaustion of his PDF Rider.

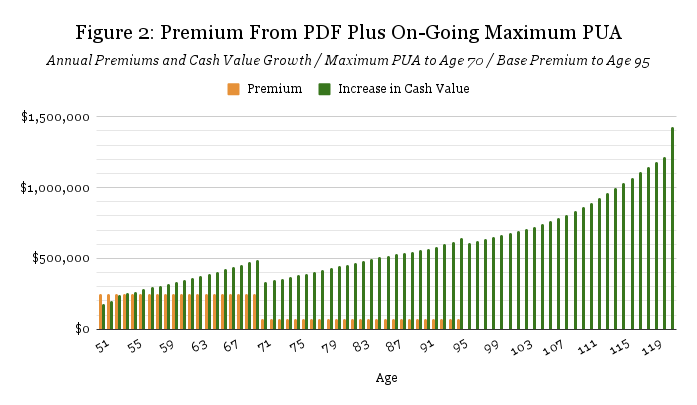

Pay attention to the change in the values along the y-axis between Figures 1 and 2.

In year 10 (age 60), the PDF Rider pays its last annual premium of $246,667. Cash value growth in that year illustrates at $333,049. Dave pays — well, Dave’s PDF Rider pays — $246,667; the value of the asset goes up by about $333,000.

Let that marinate for a minute.

In year 11 (age 61), Dave doesn’t have to pay anymore premium, as we explored in the discussion around Figure 1.

But because we built in a strong base premium and the proper long-dated level term rider, he could if he wanted to.

Well, might he want to?

Illustrated cash value growth in year 11 (age 61), assuming maximum premium paid out-of-pocket, is $346,845. Compare to year 11 (age 61) annual cash value growth of $100,199 if Dave chose not to pay any premium out-of-pocket and to Premium Offset instead.

Think about that. Dave will have this contract that gives him the right to pay $x. And if he did (again, assuming the current experience of the company), the value of the contract — which he has a contractual right to collateralize — is illustrated to increase by about $1.4(x) [$346,845 in annual cash value growth is 140.6% of $246,667].

Would you make that payment?

I expect that if you had the cash flow, you would. In fact, I expect that the only reason you wouldn’t make that payment is if you didn’t have the money. And fair enough! That may well end up being the case for Dave; he may not be able to make that payment. If that is the case, all is well. Dave doesn’t have to do anything.

We should note that this isn’t an “all or nothing” sort of deal. Maybe Dave doesn’t have sufficient free cash flow in 10 years to pay the maximum allowable premium of $246,667. But maybe he’s got some of it. With this particular company, Dave’s got all sorts of options. At the beginning of year 11, he could pay nothing (i.e. full Premium Offset); he could pay the maximum allowable; he could pay only base and term rider premium and no PUA premium; he could pay base and term rider premium and some PUA premium; he could pay only some base and term rider premium, no PUA premium, and use a partial Premium Offset to pay the rest of his base and term rider premiums; and more.

This is why it’s better to think of IBC-style whole life as a premium payment and cash value generation structure.

This structure constitutes a certain, contractually-enumerated capacity for the policy owner to pay premium, of which the policy owner may or may not choose to take full advantage. With long term-oriented policy design and proper company selection, we can preserve maximum payment flexibility within the structure while simultaneously maintaining overall preferable tax status. Dave’s got flexibility.

Returning to Figure 2, Dave could pay his $246,667 in maximum annual premium up through the 20th year.

What might his late-life passive cash-flow look like given all of this additional premium?

One option is he could double the magnitude of his annual partial surrenders late in life. This would generate $300,000 per year in passive, tax-free cash-flow from age 70 to 90. That means total late-life distributions of $6,000,000 on a cost basis of $4,466,670 ($2,000,000 in initial PDF Rider funding plus 10 years of on-going annual premium of $246,667 per year). All without triggering income tax. All in a non-market correlated environment.

Of course, cash values in the second decade of the policy would be substantially greater, too. Cash value at age 65 assuming on-going maximum premium payment illustrates at $4,558,867 compared to $3,214,532 when we assume Premium Offset beginning in year 11.

In general, the greater the premium and the longer it’s paid, the better the results will be in terms of annual cash value growth and, ultimately, late-life passive cash flow.

We’ve walked through a hyper-specific example here. We assumed a 10-year timeline over which premiums are paid by the PDF Rider. That could change. The duration could be much shorter and the annual premiums much higher. We talked about starting at age 50. We looked at passive cash flow late in life starting at age 70 and continuing through age 90.

None of this is set in stone.

There’s a learning curve when it comes to IBC. We’re so used to thinking in terms of rules and tax implications and required minimum distributions and contribution caps and early withdrawal penalties and vesting limits, that all this freedom in the design and use of dividend-paying whole life feels foreign. The image of the warden throwing open the jail house gates where the prisoners refuse to leave for fear of the unknown comes to mind.

Let’s not forget what’s not shown in the graph! That is, all of the expense, both in terms of time, fees, and interest costs that Dave will save should he choose to finance the things he was going to buy over the next 10–20+ years anyway! Cars, business equipment, you name it. A great home for those interest savings, by the way, is additional premium, which this policy is built to accept (!!!).

Let me push you further. We don’t want to miss the forest for the trees here. Eventually good financial strategy matures into intergenerational capital transfer planning (i.e. estate planning). Suppose Dave does use the next few decades to accumulate more wealth (I mean that literally, i.e. property). Dave’s got kids! Maybe Dave’s kids don’t want or will have no use for or won’t know how to operate or manage the real estate or the business equipment or whatever else Dave accumulates between now and his golden years.

One thing Dave could do — and this applies broadly across IBC, not just with PDF Rider cases — is choose to take his annual passive cash flow late in life, not by partial surrender, but by policy loan. That is, Dave could purposefully build up an indebtedness to the company on the expectation that there will come a time when it may be best to start selling off other assets. Proceeds from the sale of these assets can be used to pay off the accumulated policy loan balance, thereby freeing up cash value and uncollateralizing or freeing up death benefit. In this manner, Dave can transfer the proceeds from the sale of property through to the next generation via death benefit, which will go to Dave beneficiaries income tax-free.

But I digress…

Alternatives?

What else could Dave have done with the proceeds of the sale of his business besides using a fraction of it as seed funding for his own personal monetary system?

Or zoom out even further. What can anyone do with unexpected, unlikely to repeat, relatively large cash windfalls?

The conventional financial services industry doesn’t have great answers.

One could buy an annuity. This is a financial instrument offered by the insurance industry whereby accumulated financial value is paid to an annuitant starting either immediately (an immediate annuity) or sometime in the future (a deferred annuity). The accumulation value of the annuity will grow over time, either according to some relatively low, fixed contractual rate (a fixed annuity), or to the movement in the value of subaccounts (a variable annuity), or to the movement in an index of some sort (an indexed annuity).

There are a few immediate drawbacks to annuities compared to IBC-style whole life. First, there is no policy loan provision to an annuity. Second, annuities are taxed like MECs (or rather, MECs are taxed like annuities); that is, the LIFO taxed status means distributions are presumed to be paid from the gains in the value of the annuity first, and are therefore taxable to some extent (see this explanation of the Annuity Exclusion Ratio). Third, some annuities (but not all!— e.g. a Straight Life Annuity) typically have some death benefit provision where the remaining balance upon the passing of the annuitant is payable to a named beneficiary. However, the benefit payable is a one-for-one reflection of the remaining balance at death, whereas death benefit on a life insurance policy is a multiple of cost basis. Fourth, the mandated financial underwriting for annuity applications can border on the extreme, especially compared to life insurance applications.

I don’t want to rag on annuities for the sake of it. They do provide a guaranteed income stream backed by the conservative, claims-paying ability of a bona fide life insurance company, and that says a lot compared to what’s on offer from the cartelized public casino known euphemistically as the stock market. But measured against IBC-style whole life with a PDF Rider, it’s really apples-to-oranges. Whole life is in a league of its own.

What else?

I suspect that what many do with large windfalls is go invest.

Here, a vital distinction comes into play between capitalization on the one hand and investment on the other.

Capitalization means to establish, nurture, and grow the quantity of and the contractual access to monetary value. Investment means to deliberately forfeit access to monetary value to someone else.

That’s the whole point of investing: you allocate money to someone or something else’s control so that he or it can go generate a cash flow, some of which you’ll eventually receive either in the form of a dividend or capital gain.

Don’t get me wrong, I’ve got nothing against investing. My encouragement is more nuanced: don’t put the cart before the horse.

I believe it’s better to capitalize first, then invest.

Put differently, I think it’s better to prioritize your own capital. Investing is a judgmental call. We say “so and so should have control over and access to my money, instead of me.” And I get it, we’ve been beaten into a state of financial submission where the Very Smart Thing to think and do is to immediately hand over access to and control over capital to other parties as soon as possible. After all, everyone one knows that merely saving or “hoarding cash under the mattress” is for idiots! Don’t you know inflation will eat away the value of the dollar?!

These cartoonish, condescending caricatures of saving are totally blind to the sort of case study we’ve explored above. I suspect the problem has to do with the lack of precision in the English language. “Saving” sounds like it could mean merely “abstaining from spending.” The saver merely abstains from consumption. And fair enough, that may be superior to profligacy and debt slavery, but you’re sort of a rube if “all” you do is “just save,” rather than invest — so mainstream financial culture says.

This is why I like the idea of capitalization better.

First, it’s what we actually care about. We tend to think in terms of money, the general medium of exchange. That what we might want to accumulate is money. But a little critical thinking might reveal that that’s obviously not the case. What we care about is the accumulation of capital — of monetary value. We don’t want to accumulate money per se, we want to accumulate property that has a monetary value. After all, money itself is just the general medium of exchange. It doesn’t “grow.” What “grows” is value.

But let’s go further. Nelson argued, and I argue that there is technical economic reasoning to back this up, that capital attracts opportunity. Put differently, the set of circumstances, which according to the individual’s judgement could be improved were the individual to intervene in some way, expands the greater the individual’s capital. In a capitalist economy based on contractual exchange — which, believe it or not, is still a thing — you can think of one’s capital as capacity to impact the material world. The more money one can get to, the greater one’s purchasing power, the better positioned the individual is to bid for and obtain control of goods and services.

In other words, I believe there’s a feedback loop between the individual’s amount of and the quality of his access to capital on the one hand, and the range of investment or entrepreneurial “opportunities” he perceives on the other. And it’s not merely about the range or the raw number of circumstances that might appear opportune to the well-capitalized individual. It’s about the quality, or the potential for monetary reward, of these more or less opportune circumstances. In contemporary parlance, the lower-risk, higher-reward, less competitive “opportunities” are on the other side of relatively high barriers to entry in the form of some sort of capital requirement, like high start-up costs.

And further! Apply these concepts in a dynamic sense. Maybe the individual might like to take advantage of multiple opportunities over time, and maybe even ones that improve in prospective return and quality over time, like those hiding behind higher and higher barriers to entry. If this is the case, then one wouldn’t be so interested in accumulation of plain old money, because once money is spent, it’s gone! What one might want instead is capital — monetary value of property that can be leveraged, borrowed against so as to grant the individual purchasing power without diminishing the underlying accumulated value.

I could go on, but you see where I’m going.

Capitalize first, and the investment landscape may actually improve. Establish a capitalization structure through which successive investment revenue and/or entrepreneurial profit can be channeled and further capitalized, and you might just create an ever-improving, ever-evolving, dynamic opportunity-landscape.

In some sense, this is just an elaboration in technical economic terms of what Nelson talked about in his airplane analogy where he stressed the importance of flying with the wind.

So what are the alternatives for your recent or upcoming windfall?

My position is that the choice is either to capitalize or to invest, that you should capitalize first, that it should be in the form of IBC-style whole life, and possibly with the assistance of a PDF Rider.

Final Thoughts

Search around online for Premium Deposit Fund Rider and you’ll find almost nothing.

The fact is that PDF Riders aren’t often used at all, much less for the purpose of IBC-style whole life design and funding.

If PDF Riders can generate such powerful results, what accounts for the relative lack of awareness of them?

We should never underestimate how rate-of-return-focused consumers of financial products can be. With the exception of the last year, interest rates have hovered around zero for well over a decade. Likewise, the financial b benefit that life insurance companies attached to their PDF Riders (via a premium discount or interest growth) was extremely low. This meant little to no premium paid from a PDF Rider that did not come from the policy owner’s own pocket. From the conventional perspective, utilizing a PDF Rider looked and felt a lot like “locking up” money for several years in exchange for little to no financial benefit.

Next is the contrasting vision for the purpose of dividend-paying whole life among life insurance companies themselves in contrast with the IBC.

Home office staff don’t go around talking about a PDF Rider as the facility through which one might use a substantial windfall as seed-funding for a personal monetary system. Often, the company narrative frames a PDF Rider as a mechanism for accepting a large one-time payment, ultimately earmarked for whole life insurance premium, in a non-MEC fashion, as an alternative to Single Premium Whole Life (SPWL). SPWL policies are MECs virtually by definition. Money allocated to a PDF Rider is not accepted as premium in that year like in a SPWL policy. PDF Rider money is “phased in” year to year, and so cash value growth is slower relative to SPWL, but the preferable non-MEC status is preserved.

Therefore, a non-MEC whole life policy with a PDF Rider helps achieve the objective of substantial death benefit instantiation that a SPWL policy might otherwise serve, but with relatively preferable tax treatment.

You can tell how this isn’t exactly relevant to a capital-centered, IBC-style discussion.

I’m speculating here, but I suspect PDF Riders aren’t often used across the industry in general. This may account for the extreme scarcity of life insurance company literature on the subject.

But even within the IBC-oriented community, PDF Riders don’t come up often. Recall our discussion of the relationship between the size of the windfall and on-going cash flow. Generally speaking, we’d need a significant differential between the magnitude of the windfall and annually recurring cash flow for a PDF Rider to be effective. Otherwise, one could just treat the windfall as something of a cushion, or head-start on premium payment that would ordinarily get paid out of recurring cash flow over time. The reality is that outsize windfalls are just more rare in a society that’s ever-more short-term oriented.

None of these circumstantial reasons for the paucity of literature on Premium Deposit Fund Riders should scare you off though. If you want to Become Your Own Banker and you want to use a significant windfall to help get you up and running, the results can be incredible. In no other context could a single influx of cash create such a powerful, growing capital generation engine that will serve you and the generations that come after you than IBC-style whole life equipped with a PDF Rider.