by Ryan Griggs

Jun 18, 2021

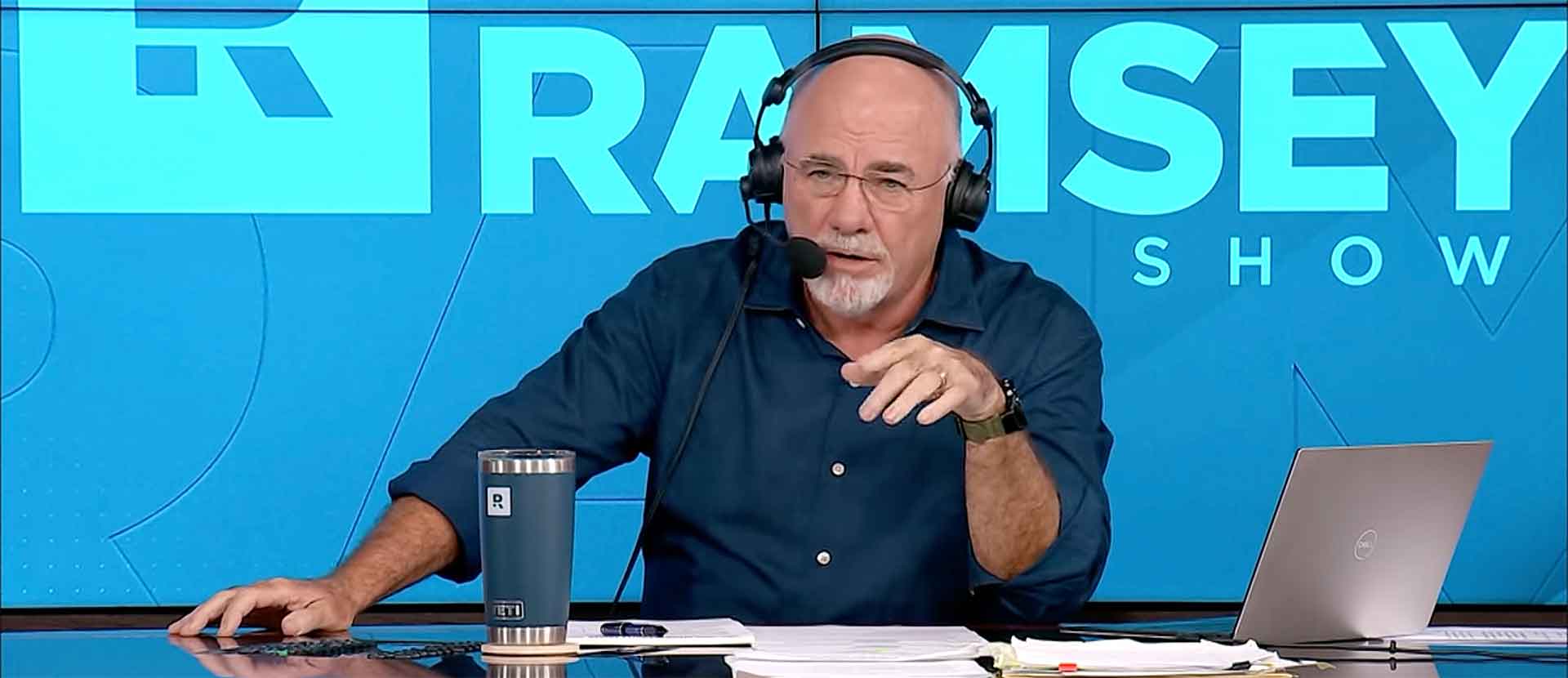

- In November of 2020, popular talk show host and financial entertainment personality, Dave Ramsey, criticized the Infinite Banking Concept (i.e. “banking” with whole life insurance) of the Nelson Nash Institute on his viewer call-in show.

- My business partner James Neathery and I responded in our New Years Day episode of the Banking with Life podcast to show that Dave was speaking out of ignorance.

- But then Dave had more to say: On 4 June, 2021, in another call-in segment, Dave responded, rather emotionally, to a caller’s inquiry regarding IBC, mistakenly referring to it as “self banking.” That video is below.

This article stands to demystify and explain, in simple terms, exhaustive though it may be, how the Infinite Banking Concept functions (and frankly, runs circles around term life insurance and — as a dividend paying asset — commercial banking all at once). After reading this post, you will understand, not only why Dave is so wrong, but how the IBC can help you achieve true financial independence.

Does Dave Know What Cash Value Is?

Dave exemplifies the old 1970’s-style “consumer advocate” persona extremely well. His down-home, central east accent and impressive rhetorical, improvisational talent can be seductive. He overwhelms his audience with his method of communication rather than the content of his message. As James Neathery and I showed in our above mentioned podcast episode, a careful examination of the substance of the situation reveals that Dave does not understand, objectively, how dividend-paying whole life insurance works. Or else, he has other motives.

Neither in the November 2020 nor in the June 2021 video is there any conversation about policy design or premium structure, which indicates that Dave is either unaware of the distinction between base and PUA premium, or is aware  and doesn’t consider the difference to be that important. Or perhaps Dave’s opinions reflect those of Zander Insurance, a leading sponsor of his company for over two decades whose insurance offerings are limited to term life.

and doesn’t consider the difference to be that important. Or perhaps Dave’s opinions reflect those of Zander Insurance, a leading sponsor of his company for over two decades whose insurance offerings are limited to term life.

But if he is aware of the difference between base and PUA premium, we might be able to understand why he wouldn’t care very much.

Simply put, I don’t think Dave understands what cash value in a dividend-paying whole life contract is. In the June 2021 video, he refers to it as a “savings account.” He mocks the proverbial straw-man insurance salesman who tells clients that utilizing cash value is like “using your own money.” You “use your own money” in a checking account, so “what could be so special about ‘using your own money’ in life insurance?” Dave retorts.

Cash value in dividend-paying whole life insurance is not your money.

For one, cash value is not money in the first place.

Money vs. Cash Value (or Capital)

There is an implicit and unspoken, resentful attitude in the financial business and among a section of the public that consumes financial products that insists on remaining un- or misinformed. The idea is that being precise in your language doesn’t matter. “Don’t draw too many distinctions, because you’ll just confuse people” — or so goes the ethos of this allegation.

People like Dave Ramsey build their bombastic personal brands by capitalizing on the ignorance that results from this condescending attitude. Words like “money” and “savings account” can be thrown around without the slightest care for nuance. Add some rhetorical flourish, some flashy production design, and that central eastern charm and viola!, you’ve got a multi-million dollar financial entertainment and advisor referral business.

But for those who do value careful thinking about such matters, some clarification is in order.

What is Money?

Money is the general medium of exchange in a specific space.

Money in the United States is the US Dollar. For a variety of reasons I won’t get into here, it is the medium deployed in exchange in order to allow people to more efficiently satisfy their desires (the short of it is that trading for a commodity

that other people desire purely for its usefulness in exchange opens up the widest, deepest, and most efficient set of available goods and services, which, in turn, the individual will consume to satisfy their preferences).

In economics, we call a “perfect substitute” for money something that acts effectively as though it were money. In other words, a perfect money substitute is something that serves the same purpose of money (facilitating exchange) but that is not money itself. The demand deposit (think of a checking account balance) is the most well-known example of a perfect substitute for money. The digits on the screen are not themselves the money. The money is Federal Reserve Notes (so-called “green pieces of paper”). But the digits on the screen act like money — or more precisely, market actors treat the digits on the screen as they do money.

In economics, we call a “perfect substitute” for money something that acts effectively as though it were money. In other words, a perfect money substitute is something that serves the same purpose of money (facilitating exchange) but that is not money itself. The demand deposit (think of a checking account balance) is the most well-known example of a perfect substitute for money. The digits on the screen are not themselves the money. The money is Federal Reserve Notes (so-called “green pieces of paper”). But the digits on the screen act like money — or more precisely, market actors treat the digits on the screen as they do money.

In other words, market participants believe that a vendor’s receipt of these digits on the screen satisfies the consumer’s debt to the vendor. When you swipe your debit card at the grocery store, the transaction is considered ultimately settled. Neither the consumer nor any other party “owes” the grocery store anything anymore. This, by the way, is why credit card balances are not money substitutes (nor are they assets) in the technical sense. When you swipe a credit card at the grocery store, someone still owes money (namely, the consumer still owes the credit card company). The transaction is not finally settled.

What is Cash Value?

Cash value in dividend-paying whole life is capital, not money.

Capital is the abstract, hypothetical, typically subjective monetary value of an asset.

Someone who knows they have equity in their home (meaning, the perceived market price of the home is believed to be greater than the debt owed to the lender), knows on some level that whatever the amount of the equity is, it is not money per se. The home owner knows that if they wanted to transform the equity in their home into money that they can spend at the grocery store, they would need to collateralize the home and borrow the actual money (probably in the form of a perfect money substitute, i.e. a checking account balance). Only then would the homeowner “have more money” in the true, technical, spendable sense.

The same goes for cash value in life insurance. A policy owner isn’t going to go down to the auto shop and attempt to pay for his oil change by presenting a copy of his policy documents just as the homeowner with equity isn’t going try paying for groceries by waiving a copy of his title documents in the clerk’s face.

No, cash value, like equity in a home, is not money. It is capital. In order to transform that capital into actual spendable, usable money, something else has to happen first.

Therefore, cash value is not your money, it is your capital.

The IBC Premiums & Dividends

This is such a vital distinction, because if we don’t grasp it, then we risk falling for dramatic over-generalizations designed to diminish and trivialize the matter. Dave’s co-host, Ken  Coleman, demonstrated this tactic by comparing paying high premiums in order to build cash value in order to be able to take a tax-free policy loan as “moving rocks from one side of the yard to the other.” If this were true, we’d fully agree. It’d be as dumb as a box of rocks.

Coleman, demonstrated this tactic by comparing paying high premiums in order to build cash value in order to be able to take a tax-free policy loan as “moving rocks from one side of the yard to the other.” If this were true, we’d fully agree. It’d be as dumb as a box of rocks.

Coleman’s analogy is entertaining but falls short of substance. If I’m going to put “my money” over here with this insurance company so that I can “take my money out” later and pay the company interest to do so, how stupid could I be?

The facts that premium is paid, that capital is generated, that a portion of a future cash flow (i.e. the death benefit) is collateralized, that the insurance company lends its money to the policy owner, and that nothing is “taken out” of the policy are totally glossed over in Dave’s opinion piece.

Premiums

By allowing space for the distinction between money and capital, we create the possibility for asking, “well, since you can’t take something out that isn’t there in the first place, what does happen?”

When a policy owner pays a premium into a properly designed contract, that premium will generate capital (equity) in the policy. How much capital is created in a given policy year depends on when the premium payment is made. In the earlier years, there’s relatively less cash value (equity) generation per dollar of premium. As the years go by, the policy owner will observe more and more cash value (equity) growth per premium dollar in a given year. This remains true until the very advanced years in the life of the contract.

A terribly vital, essential characteristic of the entire IBC process is precisely that this capital growth process is never interrupted. In Dave’s co-host’s silly example, the rocks never leave the one side of the yard.

If Dave does understand what cash value is (and he either doesn’t or isn’t letting on), then he certainly does not understand what can happen to cash value over time if it is left to increase every year — as it should be.

Dividends

Let me say this loud and clear: a policy owner who systemically pays their premium over time will have cash value in their policy equal to a multiple of the total premium they’ve paid to the life insurance company.

Dare I say, in fact, that this is one of the main reasons for “banking,” i.e. of deliberately building capital inside of a whole life policy. Namely, that the total capital growth over the individual’s lifetime will far-and-away exceed how much premium they’ve paid during the same time period. It’s as though there will be far more rocks piled up on the side of the yard than the individual put there themself.

Now how in the world could that be? The answer is: because rocks are not capital.

(Don’t expect me to keep carrying this example forward — it’s just too basic. Although it is true and economists would be proud.)

In life insurance, we aren’t just stockpiling Federal Reserve Notes. We are initiating a relationship between an individual, a life insurance company, and a future cash flow, i.e. a death benefit.

Cash Value vs. Future Death Benefit

I cannot understate this. When an individual becomes a policy owner, he or she creates a contractual relationship that entitles them to the payment of an actuarially-sound lump sum of money to their people  (called beneficiaries) upon their passing. In other words, the individual is agreeing to a schedule of future premium payments that they’ll pay while they are alive. And in return, the company will pay one giant lump sum whenever they die. The marvel of actuarial science, a science of the statistics of death at a population level, if you will, makes this financially possible for the life insurance company, so long as they’re doing the same sort of thing with a large enough number of other people at the same time.

(called beneficiaries) upon their passing. In other words, the individual is agreeing to a schedule of future premium payments that they’ll pay while they are alive. And in return, the company will pay one giant lump sum whenever they die. The marvel of actuarial science, a science of the statistics of death at a population level, if you will, makes this financially possible for the life insurance company, so long as they’re doing the same sort of thing with a large enough number of other people at the same time.

In short, a life insurance company is promising to pay a future cash flow.

Now, follow this closely:

Future cash flows have present values.

$100 in a year from now might be worth $90 today.

In life insurance, the (net) present value of a specific kind of future cash flow, called a death benefit, has a specific name.

It is called cash value.

Cash value is the net present value of the death benefit. That is, the present value of the future death benefit, net of on-going costs required to keep the death benefit payable (i.e. “in force”) is called cash value.

Cash value is not money. It is not your money. It is not a savings account. It sure as hell is not anything remotely similar to a pile of rocks (rocks, for instance, are not sufficient collateral to get a loan of money from a lender).

So how can cash value be both capital and the net present value of the death benefit? How do those two things integrate together?

Net Present Value

It goes like this: cash value is capital because it is the net present value of the death benefit.

What does this “net present value” terminology mean? It refers to what the future death benefit is worth today in terms of actual money. This is why the cash value is also called surrender value. In other words, if you chose to surrender the contract, i.e. to forfeit your claim to the future death benefit, then the life insurance company would owe you some money. As the insured ages and approaches mortality, the surrender value of a contract increases. As the surrender value of the contract increases, the likelihood that a policy owner may in fact surrender the contract in exchange for the cash value also increases.

The policy loan is the mechanism by which the company offers the policy owner the ability to benefit from the accumulated value in the contract without having to surrender it.

Therefore, because cash value in dividend paying whole life is what the death benefit is worth today, and in order to allow policy owners to benefit from this accumulated value without having to surrender the policy while the insured is still living, cash value is treated as a proxy for the quantity of death benefit that the company is willing to collateralize. It is short hand. The company is saying, “because the death benefit is worth this much today, we’re willing to lend you money up to that amount, so that you can benefit from what is effectively the equivalent of this accumulated value while you’re alive and you don’t have to stop being our customer.”

Frankly, it’s a pretty clever arrangement (maybe one that even calls for a bit of gratitude). What other sort of company do you know of that simultaneously (1) produces an intangible, highly durable consumption good in which the customer can generate equity and (2) will lend against the increasing value of the good on demand? I’ll wait.

Why Dave Ramsey is Wrong About the IBC

Amusingly, after demonstrating a sophomoric misconception of what cash value is, Dave then turns to mocking the method by which individuals make use of their cash value in dividend-paying whole life insurance.

He seems to think it’s a revelation that a policy loan is a credit instrument.

(He calls it a debt. It’s not. A policy loan is the name of the cash flow from the life insurance company to the policy owner collateralized by some of the death benefit on the policy. The amount of the policy loan appears as cash on the left side of the individual’s balance sheet. The liability on the right side of the policy owner’s balance sheet after the receipt of the policy loan is the debt. The loan causes the debt; it is not a debt in and of itself. When Dave says “debt is not taxable,” he’s trying to say that credit or loans are not taxable cash flows in the way that income is a taxable cash flow.)

But Dave’s point (I’m steel-manning here) is this: who cares if the policy loan is a non-taxable method of leveraging cash value, because you pay interest for the loan — so sure, there isn’t tax, but that doesn’t mean there’s no cost, because there is a cost in the form of policy loan interest.

The implication is that whatever cash value growth might be possible in whole life insurance must be outweighed by the costs (i.e. policy loan interest) associated with leveraging or accessing that new value.

One might observe that so long as we believe that the total cash value growth is equal to or less than one’s cumulative, lifetime premium payments (i.e. cost basis), then we can kind of understand Dave’s point. Why would I want to pay total premiums of $X, in order to generate total cash value equal to or less than $X, in order to then take a policy loan of an amount up to $X, only to then pay interest to the life insurance company? It would seem like the net result would be that I now have $X-i where i is the interest cost associated with the policy loan. And since $X-i is less than $X, this whole “banking with life insurance” thing must be pretty stupid.

However…

What if cash value growth in dividend paying whole life insurance is not limited to your cost basis?

What if you can generate way more cash value than cost basis — than total premium paid in — over time? What if the increase in cash value over and above the cost basis is way, way more than the interest cost required to leverage that cash value?

What if the increase in the cash value over the life of the contract will exceed the cost basis by double, and eventually by triple, digit percentages? What if the terms of the asset state that the owner has the contractual right to borrow against that surplus value without triggering a taxable event?

Why Infinite Banking Works for Everyone

Ordinarily, if the value of an asset you own appreciates and you want to personally benefit from that rise in value, you often have to sell the asset. My grandfather left me quite the collection of firearms, all of which have more than tripled in value. If I want to exercise the purchasing power embedded within that increased value, I must first sell the guns. And technically, the sale of an appreciated asset generates a taxable capital gain. This is one reason why firearms are not an ideal asset for the purpose of systematic, optimal capital accumulation.

But whole life insurance is.

One of the reasons whole life insurance is the optimal place to accumulate capital is because that “gain” that Dave references, which by the way, does not take as long to generate as Dave implies and will actually exceed what the policy owner pays in premium. Despite Dave and his rock-collecting co-host’s vitriolic condemnation of the claim that cash value grows uninterrupted by tax, the truth stands. Cash value does grow without interruption by any kind of tax and a policy loan is a tax-free mechanism of accessing and utilizing that growth that will eventually exceed the cost basis in the contract.

One of the reasons whole life insurance is the optimal place to accumulate capital is because that “gain” that Dave references, which by the way, does not take as long to generate as Dave implies and will actually exceed what the policy owner pays in premium. Despite Dave and his rock-collecting co-host’s vitriolic condemnation of the claim that cash value grows uninterrupted by tax, the truth stands. Cash value does grow without interruption by any kind of tax and a policy loan is a tax-free mechanism of accessing and utilizing that growth that will eventually exceed the cost basis in the contract.

(For the entirety of the analysis, I assume that the policy is not a Modified Endowment Contract.)

So at first — and this may have been your response if you’re practicing the IBC and have watched Dave’s video — it seems puzzling to us that Dave would shout and scream about how obvious it is that policy loans are non-taxable cash flows. It’s as if Dave thinks advocates of the IBC are immaturely over-emphasizing this fact.

Well, Dave, there is no other asset in which the on-going equity growth surpasses what you pay into it and that occurs without interruption by tax, in a totally private, creditor-and litigant-protected, intangible, contractual environment. The provisions of which give you the unilateral right to borrow against the entire value and to control the resulting indebtedness including whether you ever even repay it. The tax-free policy loan is a crucial component of this list of traits.

Other assets cannot hold a candle to the features of whole life insurance in the context of optimal capital management.

Closing Remarks

Dave’s flirtation with total ignorance about the mechanics of — and what’s possible with — whole life insurance leads him to unintentional, fleeting alignment with the truth. For instance, he says that certain tax-qualified investments are “on another planet!” relative to what happens in cash value in whole life insurance. I couldn’t agree more. I’m not a tax or investment advisor, so this isn’t tax or investment advice, but if someone is chomping at the bit to store up a whole bunch of capital in a collection of assets they probably don’t understand, that are controlled and managed by people they don’t know, which have an uncertain value connected directly to the fractional reserve banking boom-and-bust cycle, access to which is virtually pay-walled off by taxes, fees, and penalties — have at it.

Whether that strategy amounts to “trying to save people” as Dave constantly proclaims is his life goal is a question for another time.

To be fair, many of my clients have had positive experiences with some of what Dave has taught in the past. They report to me that his methods have helped them get out of conventional debts, for instance. To the extent Dave has helped people in this way, of course, more power to him.

To the extent that Dave is propagating an economically ignorant, emotively impassioned disgust towards the most ideal asset on the planet for the purposes of optimal capital accumulation and deployment over an individual’s lifetime (and possibly at the behest of his sponsors), Dave, you can do better.

Editor’s note 7 August, 2021: This article was updated to provide additional information about Ramsey Solutions and its sponsors, include source links, and reflect the current product experience.