In this article I want to start by briefly reviewing some of the key components of the groundwork I initially laid out in Part I and then walk through some actual numerical illustrations that will help expand our understanding of this unique tax idea. As a reminder we are specifically discussing a tax strategy that calls for taking the cash flows that are already earmarked for paying your taxes and re-routing them through a correctly designed IBC policy that has the capacity to adjust to your particular situation and provide the freedom to not be dependent on outside bankers. As before, I want to emphasize that this idea does NOT reduce your tax liability—I am simply presenting options for people to redirect cash flows that would occur anyway.

Additionally, one of the most important points I made in the previous article was that this idea would resonate most strongly with business owners because they have a unique distinction that employees on a fixed income do not have. This main difference is their ability to create “windfalls” through either their business profits, or the selling of business assets. These actions can even include the selling of the entire business as the final sale and exit strategy when the business owner reaches that time in life for receiving passive income from investments. As we will see, the strategy I outline in this article is most advantageous to people with volatile income streams, which is why it should appeal to business owners first and foremost.

In the initial discussion it was important for me to walk through the mechanics of a specially designed IBC policy as well as some of its most important attributes in order to impress upon the reader that after careful inspection of each of these qualities that it would dawn on the business owner, that this really is the best place where one’s wealth should be “warehoused” (to use Nelson Nash’s term). Since this has so many of the qualities of the perfect investment, why wouldn’t we want to store most of our money here, as a “headquarters” if you will, while considering other potential investments?

Among these qualities I described of a properly structured dividend-paying whole life policy, these three stand out as being particularly important:

Access and Control Over Your Money: If you have cash value in your policy you have a contractual right to policy loans.

Flexibility of Repayment Terms: Although an outstanding policy loan rolls over at interest, you can pay it back on your own schedule, or even not at all, if you wish.

Uninterrupted Compounding Of Your Money: Whatever amount you borrow—that same amount continues to earn money in the form of interest, dividends, and equity in your policy as long as you live and as long as your policy remains in force.

By combining all of these important aspects of the living benefits of an insurance contract the hope was that one could more easily see that a specially designed IBC policy was actually the ideal cash flow and financing system for a business owner, instead of a commercial bank or any other type of investment.

Where else, but here, would a business owner put his increased profits or the proceeds from the sale of business assets? The problem is that many people don’t have a steady flow of free cash to quickly fund a policy such as this, which is why I am suggesting you use your recurring tax bill as a way to get your IBC policy up and running.

Remember, the idea isn’t that you are reducing your tax liability or that there is “free money” here. It’s that you are flowing a regular expense (such as taxes) through the policy first. I’m picking taxes in this article because everybody pays taxes, but I could have picked any big, recurring expense. The point is that by building up the policy and taking out policy loans to pay your taxes, you (a) have a nice fat death benefit in case you die prematurely, and (b) have a much more flexible instrument that you can implicitly fund through windfalls. You can pay down your loans as your business success allows.

Examining The Numbers

We are going to examine and walk through two different hypothetical business situations so let me first introduce both scenarios. In the first example we will be studying the variables involved when using only the cash flows earmarked for taxes going into the policy and directly into the cash values. This is necessary because this money will need to be immediately available for a policy loan in order to be able to pay the tax.

This recurring cash flow will be shown going into the policy each year for a period of 10 years, combined with the minimal costs associated with the establishment of the base policy and its special riders. Since this cash flow will represent a substantial amount of funds coming into an insurance contract and going straight into the cash value portion of the policy, this special design is necessary in order to accommodate that type of over-funding and not create a Modified Endowment Contract (MEC).1

In layman’s terms, a MEC indicates that an insurance contract is primarily being used as an investment instrument instead of life insurance, and with modern tax and regulatory treatment a MEC loses many of the advantages of a standard policy. To avoid this situation we must use IRS Rule-IRC 7702,2 which means that a minimal amount of those funds will be required to set up the base part of the policy in order to allow the larger influx of cash flow to go directly into cash value. In this first illustration those amounts will be reflected as additional required funds separate from the tax bill cash flows. This additional cost is minimal and a business owner who recognizes the value of this infrastructure and asset should be happy to pay it.

In the second scenario we will be examining the same special IBC policy design, but it will demonstrate what business owners can do by “pre-planning” their company profits and taxes ahead of time. When this strategy is utilized, the funding of the specially designed IBC policy is achieved with the entire profits of the business (before taxes) instead of just with the tax bill cash flows. I should add right here that this strategy could also be done with the proceeds from the sale of a business asset (before taxes). Nevertheless, this strategy is achieved by way of corporate bonuses, or draws paid to the business owner and taken out toward the end of the year. In this way, no additional cash flow is required to fund the base policy as in Illustration I and more of the cash flow shows up in the growth of the dividends, the cash value portion of the policy and in the death benefit.

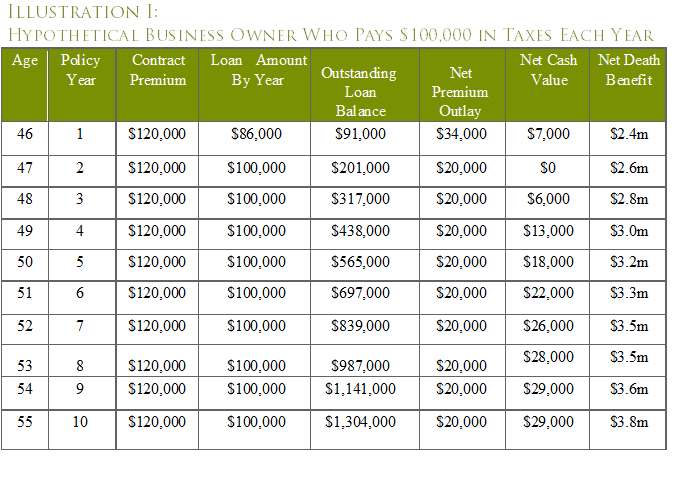

Now let’s look at the first illustration, Illustration I. For convenience I have rounded the numbers off, but the table is based on an actual illustration; I wanted these numbers to be realistic. I should also stress that there are a lot of real-world considerations going into the design of this policy and the illustration I’ve shown you. I must stress that you should take your individual situation and describe it to someone who has been properly trained in IBC; I can only touch on some of the highlights in this article.

Illustration I is predicated on the assumption that the business owner’s recurring tax bill is $100,000 and that this amount is being deposited directly into the cash value portion of the policy. (I am aware that many business owners have tax bills ranging in the millions of dollars. I used $100,000 for simplicity’s sake and for its adaptability in adjusting it to your own particular situation.)

The first thing to keep in mind as you study this illustration is to understand that the base policy, which has only $1 million in death benefit, cannot possibly take in $1 million in premium payments over 10 years and have them go directly into cash value without the policy becoming a MEC. We would not want that to happen or we would lose many of the important attributes that we have been discussing in these two articles and what makes dividend paying Whole Life insurance such a unique tax beneficial financial product.

Prior to 1988, wealthy individuals could easily write one big fat check and drop it into a “single” premium Whole-Life insurance policy and it would not be a MEC. Many people took advantage of this opportunity after the Tax Reform Act of 1986, which removed much of the special treatment given to real estate investments. Nowadays, a typical single premium whole life insurance policy would be classified as a MEC; otherwise this is what I would recommend we all do instead of configuring these insurance contracts in this special way. But we must do it this way if we wish to over fund a policy and be sure to follow the new IRS guidelines. The good news is that all Authorized IBC Practitioners—graduates of the course that Nelson Nash, David Stearns, Bob Murphy, and I have created—know exactly how to configure these policies in this special way.

This special configuration, which includes the special riders that are added to this particular base policy, must account and provide enough money for the cost of the insurance. This cost includes proportioned projected amounts of life insurance company expenses having to do with, mortality, loads, surrenders, and contingency funds, which are all built into the premium payment. These are all statutory requirements we cannot get around when dealing with life insurance. In this illustration that cost for this policy with $1 million in over funding within a 10 year period is approximately $1,700 per month or roughly $20,000 annually.

(I should also mention that there is one more distinct feature that we should point out about the specially designed IBC policy that is not often stressed and you should have no problem guessing why. That important feature is that the load expense, that portion of the cost of insurance that includes the commissions paid for the policy set-up, are considerably less than commissions paid on traditional permanent life insurance policies. In other words, for a given amount of premium payment flowing into the policy per year, a financial professional earns a lower commission configuring the policy in the “IBC” way versus a more conventional approach. This makes the special configuration of these policies, in order to over fund them legally, well worth it to the consumer, and it is yet another reason that I urge anyone seeking more information to only work with professionals who are located on our Practitioner Finder at www.infinitebanking.org/finder.)

To summarize, in Illustration I we have a business owner who normally would pay $100,000 in taxes every year. What we’ve done is have him roll that payment into a $120,000 premium payment for a specially designed life insurance policy, out of which he borrows $100,000 each year in order to pay his tax bill.

Now notice that this isn’t merely a “wash.” (There is some “drag” in Year 1 for technical reasons of policy design; I only have the business owner borrowing out $86,000 in that first year, meaning he would have to kick in the other $14,000 to pay his taxes, which is necessary to get the whole thing up and running.) In other words, that column showing “Net Cash Value” indicates how much extra cash is available to borrow in case the business owner needs it. But you can also see that from Years 1 through 10 he is borrowing out the money to pay his tax bill.

If you want to see how much “out of pocket” the life insurance is adding to the entire operation, look at the “Net Premium Outlay” column. That is showing how much the business owner is kicking in over and above the amount he originally earmarked for paying his taxes. In other words, when evaluating the overall marginal costs and marginal benefits of doing things this way (of just paying the $100,000 to the IRS every year), you want to look at this “Net Premium Outlay” column and then consider all of the benefits you gain by owning this policy as it matures over time.

Now at this point a perceptive reader might wonder: Why am I mixing the tax payments into this discussion? After all, if the business owner wants a modest whole life policy, why not just separately fund it with his free cash flow, instead of the particular arrangement depicted in Illustration 1?

There are two main reasons. First, by building up a large infrastructure, the business owner now has plenty of room in case he has a windfall—maybe because he has a very profitable year, or perhaps because he sells a business asset. At any point, he can take excess cash flow from the business (after he pays income tax on it of course) and use it to pay down the outstanding policy loan. That will show up dollar for dollar as more Net Cash Value immediately available to borrow, and it will boost the Net Death Benefit available. In other words, even though the net amounts of cash available are modest in Illustration 1 above, look at the gross warehouse we’ve created for newfound wealth: In Year 10 of the policy, there is room to devote $1,304,000 to paying off the policy loan (another way to think of over funding the policy even further), thus making that amount added to the available net cash and net death benefit.

But there is a second reason that I like in the strategy shown in Illustration 1. Even without windfalls, look at the sizeable piece of property the business owner is building up. In particular, look at the death benefit. It is amazing to me that so many people talk about the cash flow properties of life insurance and yet they lose sight of the value of the death benefit! For example, even in just the fourth year of the policy, the net death benefit—meaning after the policy loan has been taken care of—is already $3 million. That will pass income-tax-free to the business owner’s beneficiaries. By Year 10, the net death benefit (net of the $1.3 million in policy loans) has grown to $3.8 million.

So in conclusion, what Illustration I shows us is that a business owner who has the ability to devote $20,000 of free cash flow each year into a whole life insurance policy can augment it tremendously by redirecting a large expense (such as a recurring tax payment) through the policy. If the business owner understands the benefits of having a modest sized policy, then he should understand the benefit of erecting the gross infrastructure for a much larger policy, waiting to warehouse his future wealth as windfalls present themselves. And, if he should unfortunately die in the meantime, then his heirs get a much larger death benefit check under this approach.

The Second Scenario: Pre-Planning Profits and Taxes

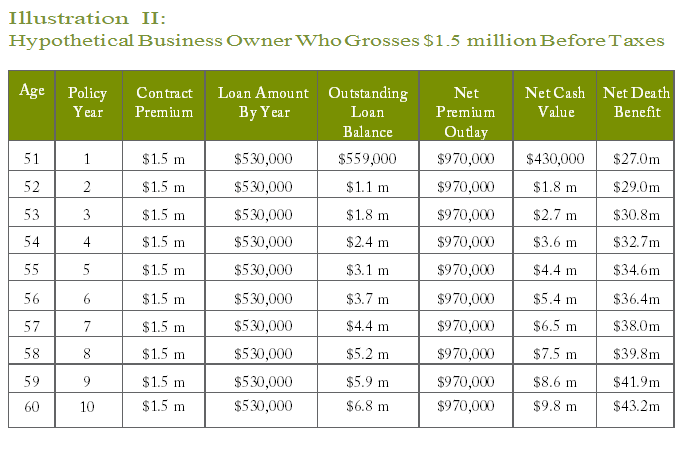

In last month’s installment of this article, in Part I, I stated that it is not possible to fully grasp the financial implications discussed here until one has become an owner of a well funded specially designed IBC policy and has been practicing IBC in their own life. So clearly the ideas discussed here are not for the novice. However, I do believe that a business owner is able to relate to what I am trying to explain here much quicker than a salaried employee on a fixed income. Business owners can relate to windfalls. They are also able to predict with some reasonable assurance how much profits and tax liability their business will generate in the present year. So Illustration II examines this pre-planning aspect of setting up a specially designed IBC policy, how the cash flows going in differ, as well as the results, and why.

In this illustration we do have the same components involved such as the base policy and its riders configured in the special design to avoid the MEC problem. However, in this example the business owner has determined that his business will earn a profit of $1.5 million this year before he pays any taxes. If the business is a “C” corporation, the business owner knows that these profits tend to accumulate and show up in his bank account and that in order to avoid paying taxes of 35% of his profits corporately and then again personally at 35-39%, that bank account needs to be emptied before the end of the year. This is a common problem of most all closely held “C” corporations.

If the business owner operates an LLC, or an “S” corporation, then his business profits will flow to him personally and he will pay 35-39% in taxes on these profits. If we assume that the business owner who operates the “C” corporation is able to zero out his corporate profits before year end and only pays personal taxes like the owner of the LLC and S, then in all these cases the tax bill will be $530,000. The profit after taxes ($970,000) goes to the business owner’s personal savings account (a commercial bank), or into an investment (land, real estate, stock market, etc.), or it is plowed back into the business and used to pay off loans, lines of credit, or left in the business as additional working capital.

What Illustration II is demonstrating is that the business owner has decided that the best place to warehouse one’s personal wealth is in a specially designed IBC policy. This is where the residual after tax money (the $970,000) should ultimately reside instead of where it has been previously placed. After all, it is easily accessible and is continually earning money, whether you take out policy loans or not. Plus, the flexibility of the repayment terms is so generous that the business owner can make the element of time work in his or her favor. Consequently, the benefit of flowing the entirety of the business profits to the business owner utilizing a bonus check or draw and then having those monies drop directly into the policy (without paying the federal tax) is the ideal tax strategy. The $530,000 tax bill on that amount of money each year is paid using policy loans as you see illustrated in this example over a period of 10 years.

As you can see in the Net Premium Outlay column the residual after tax money (the $970,000) is how much the business owner is kicking into the policy over and above the money that is ultimately destined for the IRS (the $530,000.). It is this net premium outlay that is effectively buying the flow of ever-growing available Net Cash Value and Net Death Benefit figures over time.

Before we examine the loan balance including the interest, which is rolling over for 10 years straight (a total of $6.8 million), check out the results of this particular policy once it is up and running. For example, after the fifth year there is $4.4 million available in cash value to borrow for any investment opportunity, and if the business owner should happen to die that year, he leaves a hefty $34.6 million death benefit to his named beneficiaries. Also note that there is $15 million in cash flowing into this policy in 10 years without it becoming a MEC. The cash value in the tenth year is close to $10 million and the death benefit is $43 million.

As with the original, more modest illustration, here too we must appreciate the tremendous infrastructure that our business owner has erected for himself. A business owner’s potential for windfalls can be “placed in” this particular policy after the tenth year with an additional $6.8 million (as of year 10) by using profits or sale of business assets to pay off the policy loans, which he should do. (I’m using “placed in” in quotation marks, because really what is happening is that he’s paying down the loan and thus reducing the lien against his gross asset.) Afterward, the dividends can be re-directed and paid to the business owner income tax free up to the point at which he has recovered his entire “cost basis” in the policy, the cash value and death benefit will continue to grow and at the death of the business owner, the death benefit passes over to the beneficiary income tax free. And all along, the amounts shown in the “Net Cash Value” column is available for immediate borrowing, should the business owner desire. This is the exact opposite of tax-qualified plans that lock your money up in prison.

If this idea appeals to you and you wish to implement it for your own business, let me remind you one last time that I encourage you to work closely with your CPA or tax advisor to get it fully structured. Once your tax advisor understands the main objective (based on what I am trying to get across in these articles) and why it is you specifically want a specially designed IBC policy of this type, your tax professional can then help you plan out the flow of these monies all within the IRS requirements pertaining to your particular corporate entity.

Supported with this assistance, together with the advice from an Authorized IBC Practitioner from our finder https://infinitebanking.org/finder/, and by using a top rated mutual life insurance company to underwrite the policy, you can be confident of having structured the ideal cash flow system.

Conclusion

The thrust of this two-part series of articles was to introduce a tax strategy that calls for taking the cash flows that are already earmarked for paying your taxes and re-routing them through a correctly designed IBC policy that has the capacity to adjust to your particular situation and provide the freedom to not be dependent on outside bankers.

I hit on this idea once I realized that many individuals simply do not have a steady flow of free cash to quickly fund a policy such as this and since we all pay taxes and they do come around every year, why not use these available cash flows to get the policy up and running?

I knew that it would appeal to business owners in particular since they already understand the necessity of practicing sound cash flow management while maintaining open lines of credit with lenders in order to keep their businesses operating profitably. But specifically, business owners have the ability to create “windfalls” through business successes and the sale of business assets that can be used to pay off policy loans with optimal flexible terms not available elsewhere.

Explaining the mechanics of these unique insurance contracts was necessary in Part I and in Part II we simply walked through the numbers to expand our understanding of how this idea would actually work.

Obviously, we were never talking about eliminating the tax bill or creating money out of nowhere, but we were illustrating that given all of its unique characteristics, including its special tax treatment, the specially designed IBC policy is ultimately where everyone should warehouse their wealth. Operating from this headquarters, money can be easily deployed to take advantage of most any business opportunity or investment. Since there is never any pressure to pay-off policy loans, time becomes our ally. In Nelson Nash’s way of expressing it, “IBC creates a very peaceful and stress-free way of life.”

References

1. Modified Endowment Contract (MEC), INVESTOPEDIA, Definition, March 5, 2017 http://www.investopedia.com/terms/m/modified-endowment-contract.asp

2. U.S. Code 7702A-Modified Endowment Contract Defined, Cornell University, Legal Information Institute, March 5, 2017

https://www.law.cornell.edu/uscode/text/26/7702A